Bitcoin Miner Stocks Primed for Rally, Plus Bitcoin Price Update

Bitcoin miners may provide Alpha during certain moments of the cycle. Also, why macro “experts” get the Fed so wrong.

Topics this week

Best public bitcoin miners

Why the Fed did not make Treasury yields crash

Public Miners Outperforming Bitcoin

It has been a great year for Bitcoin miner stocks. The Valkyrie Bitcoin Miner ETF (WGMI) is up 250% versus bitcoin’s 150%. It’s going to be hard to keep that up as bitcoin makes its way through this bull market, but they provide alpha to a bitcoin-heavy portfolio. Let’s take a look at three miners’ stocks I’m watching. Is there still opportunity in the mining stocks?

Below, I selected three miners to examine. They’ve gone up a lot this year already, but they all look like there’s room to go higher.

We will start with the largest by market cap and work our way down. Marathon Digital Holdings (MARA) operates 23 EH/s hash rate and produced 1,151 BTC in November and holds a whooping 14,025 BTC. They have produced 10,946 BTC YTD through November. Using an estimate for December, we can say they will mine 12,000 BTC in 2023. Their market cap is $5.2 billion.

Riot Platforms (RIOT) is the second largest Bitcoin miner by market cap. They operate 12.4 EH/s hash rate, produced 552 BTC in November, on track to produce 6,500 BTC in 2023, holding 7,358 BTC, and currently haves a market cap of $3.6 billion.

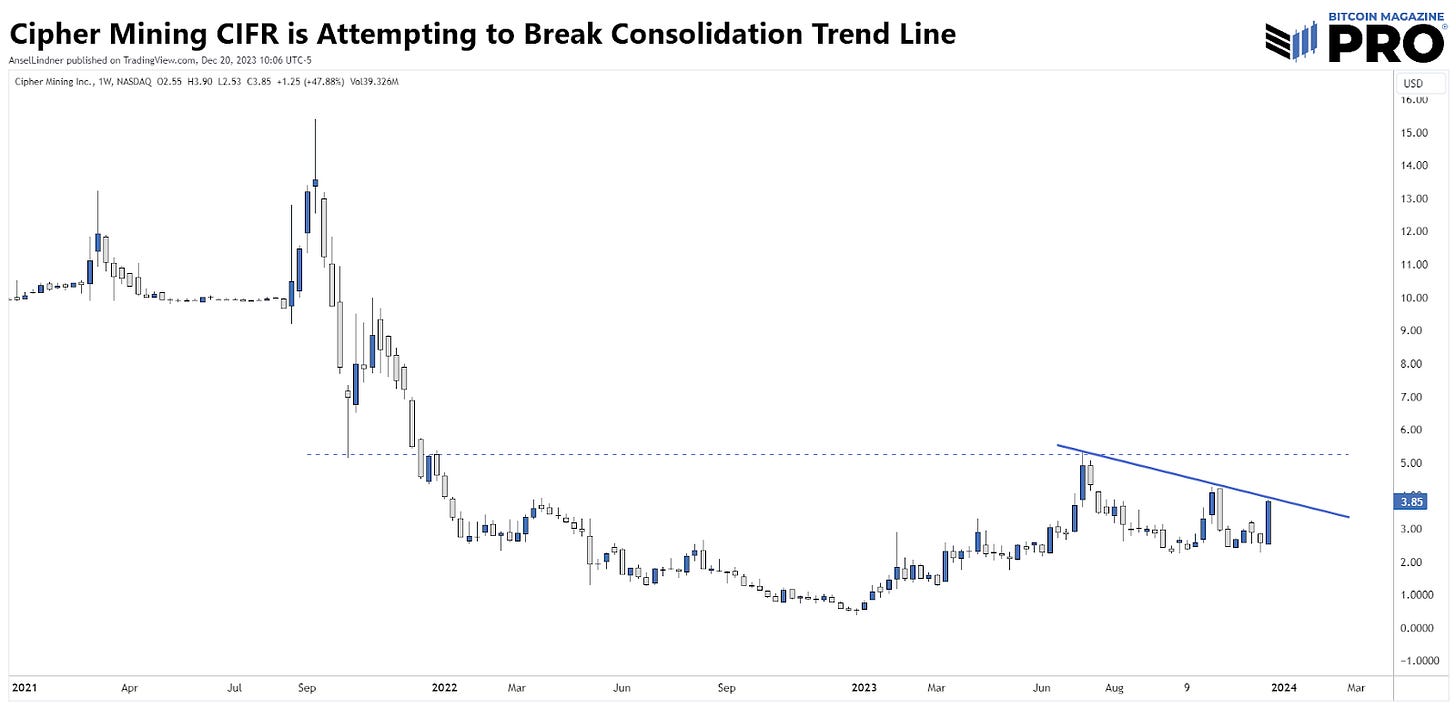

Lastly, I’ve selected Cipher Mining (CIFR). They aren’t the third largest miner yet, but they recently announced the purchase of an additional 7.1 EH/s. When added to their existing hash rate of 7.2 EH/s, they might leapfrog RIOT into the second largest miner by hash rate, if RIOT doesn’t expand as rapidly. Cipher produced 433 BTC in November and 4,465 BTC YTD through November. They only hold 558 BTC however, which is much less than RIOT or MARA. Their market cap is $976 million.

Bitcoin itself has had a fantastic 2023! While there are some opportunities to diversify into bitcoin-related assets, holding is the tried and true method to benefit in this space. Bringing our analysis to the bitcoin chart, the daily chart has several important levels I’ve been watching. Last week I pointed out the strength of $40k as support which has held so far. It’s still too soon to say $40k will never be broken again, but we might get there soon.

The level we need to close above before the price can go to the next target is $44,193. Bitcoin loves to triangle in bull markets and what is interesting is if we extend a triangle in our current pattern, the triangle ends right at the January 10 ETF deadline. The 50-day moving average is also rapidly approaching $40k adding more strength to that support.

We are all waiting for the ETF approvals. We can get lost in our bullishness, but it is incredible to note the utter lack of negative developments around the ETFs. Everyday we get another step toward approval. Blackrock and the other applicants pushing for in-kind vs cash creates this week have caved to SEC concerns. Those concerns, as reported this morning, stem from the possibility of using in-kind creates for money laundering. Cash creates address that concern.

So, here we are with all the ducks in a row. Applicants are making the rounds on financial news shows saying they are very confident of approval and starting their marketing push. The betting markets now have approval as a heavy favorite. All this, yet the price remains at only $44k.

Macro “Experts” Are Wrong About The Fed

Everyone is crediting Federal Reserve Chairman Powell with causing the recent continuation in markets blaming one comment about rate cuts next year. No, Powell’s comments opened people’s eyes to the trend already underway!

Long-time readers will be aware of my dissident bitcoiner status. I’ve made consistent stands on out-of-consensus calls for a strong dollar, falling oil, transitory CPI, and a collapsing Chinese model; all in line with a unique macro thesis and all correct. My most recent calls have been made publicly on this letter starting back in September. They have developed into a pre-recessionary collection of macro themes.

We start from the fact that all reports of lending activity in the US have been very negative, meaning deflation is already underway. That simple fact alone tells us a deep recession is coming. Next, we add in the seasonality of markets. Most acute crises occur in a narrow window around the end of Q1 or Q3 for various reasons. If we are to have a recession, it will most likely begin in 2024 around those windows, meaning we have some time. How do markets tend to behave in the build up to recession?

Stocks perform well the 18 months leading into a recession

It is not surprising that stocks have rallied since the end of Q3 bottleneck. Anticipation of rate cuts does not cause stocks to rally. Lower rates mean money is getting tight, the economy is deteriorating and the market knows it. Stocks rally in this situation because people don’t want to put their money into hiring or expanding business. They’d rather save in the stock market (blue chips/FAANGS/Mag 7).

From Top Recession Trades, Will Bitcoin Breakout Soon?

Oil and commodities will soften as demand drops

Have you noticed, all the $200/bbl doom and gloomers are gone? Despite 4-5 mmbd cuts from OPEC+, oil price remains relatively low because demand is weak.

This commodity trade is easy to understand. Recession means less demand relative to supply so commodities fall. Talk about lack of investment into the sector by commentators does not consider that the global economy is deglobalizing and already beginning the extended period of declining demand. Commodities indices are way down, and we haven’t even hit the recession yet.

This week saw a new record high production of 13.3 mmbd on fewer rigs. The technology advancement in shale continues, allowing frackers to get 50% more out of each well due to greater horizontal drilling technology.

Source: EIA

Treasury yields will fall in flight to safety

The Fed is not to blame for bond yields collapsing. They have been collapsing long before last week! The US 10-year topped back on October 23 at 5.02% and is now 3.87%! The danger of Fed mythology is that you won’t recognize this as a pre-recession signal. Instead, you will think good times are ahead because the Fed will cut rates: The exact opposite of what’s happening.

The Fed will cut rates because the economy is deteriorating. The market is the independent variable, the Fed is the dependent variable.

Bitcoin will rally as a safe haven asset and deflation hedge

Recession is coming no matter what the Fed does. We need to be mentally prepared for a deflationary shock. Money printing has already been net negative for 6 months: When that hits the economy, it’s going to be bad. Bitcoin is an asset outside the traditional credit-based system, without credit counterparty risk, and in a technology adoption phase. It’s the premier safe haven against both deflation and inflation.

What can we expect during deep recession?