Bitcoin Market Weekly Analysis - Feb 27 2024

Discover weekly insights into Bitcoin's performance, global economic influences, and strategic investment implications.

Introduction

This week’s Bull/Bear count is unchanged, but the individual metrics suggest market dynamics which are sensitive to global economic trends and investor sentiment. We have definitely entered the robust mid-cycle phase of the bull market, but an important metric is signaling caution, we might be getting overextended already.

Decoding Bitcoin's On-Chain Metrics

Analysis of Bitcoin's on-chain metrics gives us a window into the underlying health and potential future price movements of Bitcoin. Our collective analysis of these on-chain metrics suggests a predominantly bullish sentiment among Bitcoin holders, with strong holding patterns and confidence from both short-term and long-term investors. However, the elevated MVRV Z-Score warrants caution, as it hints at a possible overvaluation in the near term.

Realized HODL Ratio: This metric, with a 30-day change of +47.12%, indicates a strong conviction among holders. A higher ratio typically reflects long-term holder confidence, signaling those who have held their Bitcoin for longer periods are not inclined to sell at the current prices.

MVRV Z-Score: MVRV is highlighting that price is significantly higher than its realized value, which could indicate that the price is approaching overvalued territory, and suggesting investor caution might be warranted about a near-term correction.

Reserve Risk: This metric shows a 21.25% increase over 30 days. Reserve Risk assesses the confidence of long-term holders relative to the price of Bitcoin; a low value combined with an upward trend suggests that the confidence among long-term investors remains high, despite any potential increase in price, reinforcing a bullish outlook.

STH LTH Costs Basis Ratio: This ratio experienced a slight decrease of 10.51% over 30 days, indicating short-term holders are currently at a lower cost basis relative to long-term holders, meaning a stable or accumulating market.

Price Metrics: Forecasting Bitcoin's Trajectory

Bitcoin's price metrics suggest a robust bullish trend in the short to medium term, supported by both the Mayer Multiple and moving averages. This could indicate continued upward price movements in the near future. Nonetheless, investors should remain cautious and consider a broader range of factors affecting the Bitcoin market to navigate potential volatility and adjust their investment strategies accordingly.

The 50DMA, 100DMA, and 200DMA all show significant increases over the 30-day period. These increases are indicative of a strong upward trend in Bitcoin's price over the medium term. The 200WMA's more modest increase of 2.79% still suggests a solid long-term foundation beneath Bitcoin's current price level. The upward trajectory in the moving averages and the Mayer Multiple suggests that investor confidence is high, and the market is in a state of bullish sentiment.

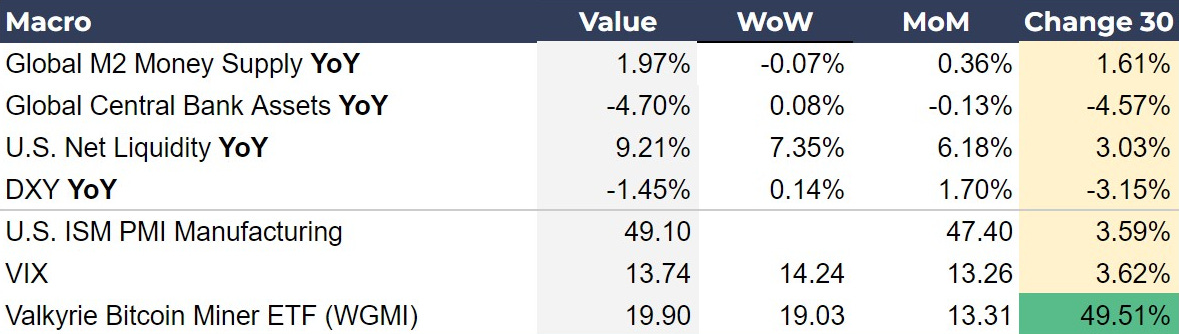

Macroeconomic Indicators: The Bigger Picture

The global macroeconomic environment plays a pivotal role in shaping investor sentiment towards Bitcoin. Expansionary monetary policies and liquidity injections are generally positive for Bitcoin. However, tightening monetary policies and economic contractions require a cautious approach.

Macro measures are showing this dichotomy in the global situation right now. M2 Money Supply and U.S. Net Liquidity indicate an expansive monetary environment conducive to growth in risk assets like Bitcoin. However, the contraction in Global Central Bank Assets suggests a tightening landscape that could challenge this growth. Investor caution should also be elevated by the ISM being under 50 in contraction, signaling a coming recession.

Derivatives Market: Sentiment and Positioning

The derivatives market provides further insight into market sentiment and investor positioning. High perpetual funding rates and futures basis premiums reflect a very bullish outlook among traders, while the options market's 25 Delta Skew indicates a reduction in pessimism, but is still negative.

Asset Correlations to Bitcoin

The US2000 shows a consistent positive correlation with Bitcoin across all observed periods, with the strongest correlation at 0.26 over 30 days. This positive correlation suggests that Bitcoin and small-cap stocks, represented by the US2000, might react similarly to certain market conditions, possibly reflecting broad positive investor sentiment lifting riskier assets.

The inverse relationship with the dollar index (DXY) may be spurious since the relationship is not as apparent over a 90-day period, but is in the last 30 days. That period has been dominated by the impact of the ETF launches. Market participants should analyze whether this correlation persists as a long-term trend or if it's a transient phenomenon influenced by the unique impact of the ETF launch.

Investment Implications and Strategies

For investors, the current financial landscape presents both opportunities and challenges. A strategic approach, mindful of Bitcoin's correlations with other assets and global economic trends, is essential. Here’s a streamlined guide to navigating these complexities:

Diversify Wisely: Incorporate assets with varying correlations to Bitcoin into your portfolio to balance risk and reward.

Stay Ahead with On-Chain Metrics: Utilize on-chain data for early signals on network trends and potential price movements, adjusting your investment strategy accordingly.

Align with the Economic Climate: Keep abreast of macroeconomic developments, recognizing their impact on Bitcoin's market dynamics and adjusting your investment stance to mitigate risks and capitalize on opportunities.

Leverage Derivatives Insights: Use derivatives market data to gauge overall market sentiment, refining your Bitcoin exposure based on these indicators.

Weekly Chart: Last Line of Resistance

Our market metrics are signaling a mega uptrend in the mid-cycle phase, and that is what we see on the chart as well. Approaching halving season, nearing the previous ATH, and battling with the last line of resistance from volume-by-price. It is historically early in the cycle to be challenging the ATH, which is another reason to respect the flash of caution in some of our metrics. This particular price zone might take a couple weeks to digest and put behind us.

Conclusion

For the financially savvy investor, understanding Bitcoin's intricate web of relationships with the financial market, economic indicators, and its own on-chain dynamics is key to navigating its volatility and seizing investment opportunities. This analysis offers a condensed yet comprehensive overview, highlighting how strategic portfolio diversification, keen observation of on-chain and price metrics, macroeconomic trend analysis, and derivatives market insights can guide investors towards making informed decisions in the Bitcoin market. By adapting to the nuanced shifts within this ecosystem, investors can position themselves to capitalize on Bitcoin's unique characteristics and potential for significant returns.

Stay tuned for our next update, where we will continue to track the important deep fundamentals and price levels. Until then, happy trading.

Full Bitcoin Magazine Pro™ Market Dashboard: 📊

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support! Please consider leaving a like if you enjoyed this piece. As well, sharing goes a long way toward helping us reach a wider audience!