Bitcoin Market Pro Analysis - March 12 2024

From On-Chain Metrics to Macroeconomic Trends: A Deep Dive into Bitcoin's Price Dynamics, Derivative Signals, and Global Economic Interactions Shaping Investor Strategies.

Today, we take a detailed look, once again, at on-chain metrics, important price indicators, derivatives market numbers, and macroeconomic stats. Each section has a summary of important data followed by some investor insights that will help you key into those important times of trend changes and capitalize on different investment strategies.

Deep Dive into On-Chain Metrics

The first thing that jumps out at the viewer of the On-chain Metrics is the extremely rapid rise of the Realized HODL Ratio and MVRV Z-score over the last 30 days. These metrics each mean something a little different. A rapid increase in HODL generally indicates that the market confidence is growing, especially among long-term holders who are either accumulating more Bitcoin or are reluctant to sell. MVRV, measuring market price to realized price, on the other hand points to potentially overheated conditions. This behavior suggests a possible mid-cycle correction, but not an end to the bull market itself.

Other metrics are showing the same thing. I’ve included the Status column and you can see that these on-chain metrics are definitely showing a progression through the bull market, but only the Percent in Profit is flashing bear. Of course, we should expect this at ATHs, but it is the first sign of potential volatility ahead.

Investor Insights

Long-Term Confidence: The rising Realized HODL Ratio and Reserve Risk suggest that long-term holders are gaining confidence in Bitcoin's future value. Investors might consider this a bullish signal, as it indicates that those with a deep understanding of the market are choosing to hold onto their assets.

Rapid Moves Hard to Maintain: The rapid rise in several metrics points to very high momentum that is hard to maintain, even with massive inflows into the spot ETFs. Investors should watch for a decrease in ETF flows as a potential indicator that the market sentiment is shifting.

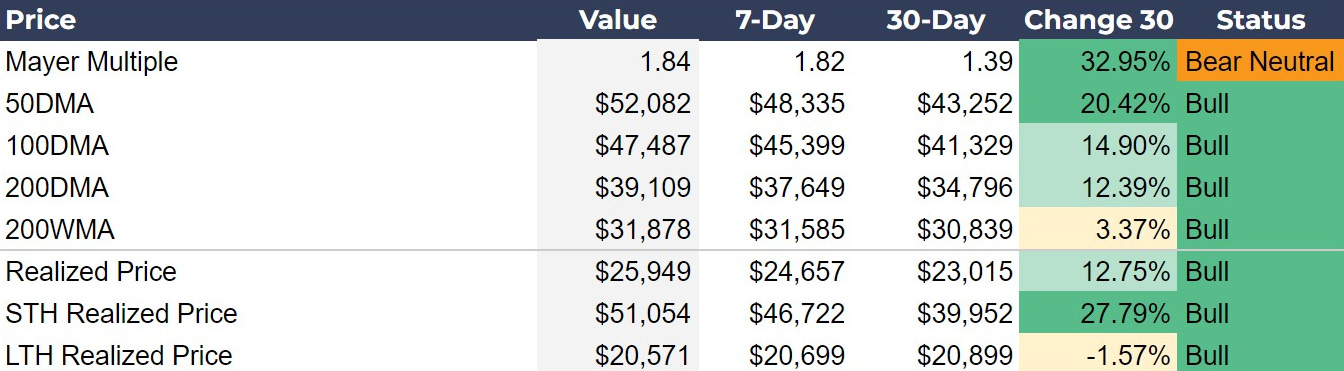

Navigating the Mix of Bullish and Bearish Price Signals

The price metrics data for Bitcoin reveals a mixture of bullish and bearish signals that investors need to navigate. The upward trends in the 50, 100, and 200DMAs, with respective increases of 20.42%, 14.90%, and 12.39%, underline a robust bullish sentiment in the market, suggesting a strong buying momentum among investors. Additionally, the Short-Term Holder (STH) Realized Price has risen by 27.79%, indicating that newer market participants are willing to buy at higher prices.

Conversely, on the bearish front, the Long-Term Holder (LTH) Realized Price is showing a slight decrease of 1.57%, which might signal a growing caution or a readiness to sell among some of the market's traditionally most steadfast investors. This could indicate a potential shift in market sentiment or a preparation for a possible market downturn. Furthermore, the significant rise in the Mayer Multiple could also be interpreted as a warning sign of overvaluation, suggesting that the market might be ripe for a correction if investor sentiment shifts or if external macroeconomic factors exert downward pressure.

The risk of volatility has risen. I’ve been trying to build the case for a cooling-off period in the bitcoin price at some point in the near future. This is not an end to the bull market, on-chain metrics and the Mayer Multiple (price relative to the 200DMA) are not at cycle extremes, but they are relatively overheated.

Investor Insights

Volatility Preparedness: With rising moving averages and a high Mayer Multiple, expect increased volatility. Long-term holders are preparing for this as represented through the falling LTH Realized Price. It is important for new holders to be mentally prepared for the volatility that comes along with bitcoin.

Correction Readiness: Amid bullish short-term signals and long-term holder caution, prepare for potential corrections. Diversification can come in a variety of ways. I never suggest shorting bitcoin or selling any significant portion of your holdings. However, if you are diversified into more volatile products like MicroStrategy (MSTR) or Coinbase (COIN) stock, you might think about reducing that exposure by going into spot bitcoin. While bitcoin itself is volatility, MSTR and COIN are more volatile and one should expect them to fall more in a market correction. More sophisticated investors can get volatility exposure to these stocks. Another way to diversify for the average investor is to delay DCA purchases until volatility plays out.

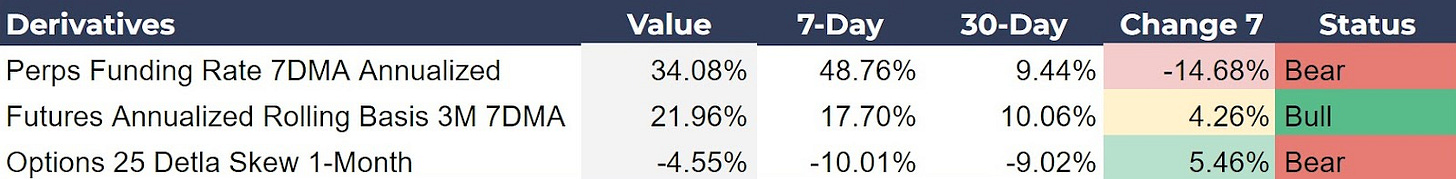

Derivative Signals and Market Expectations

Just a quick note on the derivatives high-level view. Perps Funding Rate is slightly lower than last week, signaling a market shift. Futures 3M Rolling Basis is extremely bullish. At 22% it means that the 3M futures product is implying a 22% price increase in the next year. That might not seem that bullish, but it is considering the market is trying to price that number in. Lastly, the Options 25 Delta Skew is still negative, but less so. The huge market rally to ATHs has not been enough to convince the options market out of its overall pessimism.

Investor Insight

A layered sentiment in the derivatives market underscores the complexity of current market dynamics. Investors should be particularly attentive to the interplay between these metrics. The cooling in perpetuals' bullishness, combined with sustained optimism in futures, could signal upcoming volatility as these differing expectations reconcile over time.

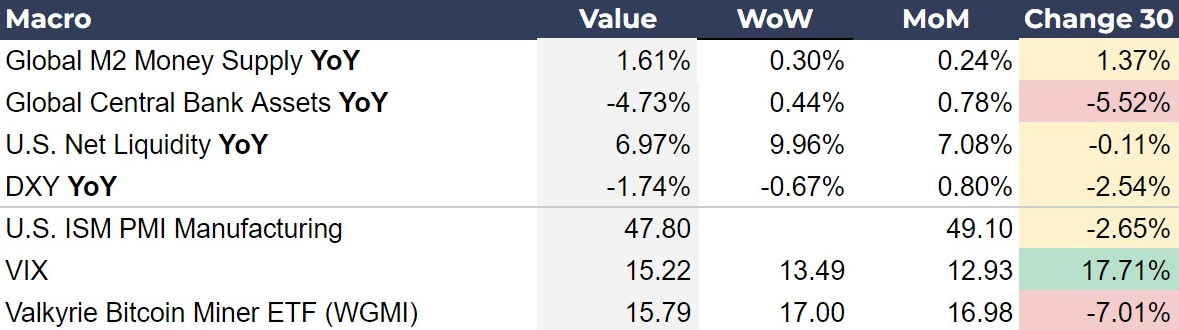

Bitcoin and Global Macro

Bitcoin is becoming a major player in global macro. JP Morgan analysts said this week that Bitcoin’s trillion dollar market cap and rally could play a role in delaying Fed Funds policy cuts by the Federal Reserve. I wouldn’t go that far yet, but Bitcoin is now the size that broad macro events affect it, and Bitcoin can affect macro in return.

Our Macro indicators are also mixed this week, like Price and On-chain. Global M2, US Net Liquidity and DXY are signaling more liquid conditions, despite shrinking Global Central Bank balance sheets, which would benefit risk assets, specifically bitcoin, via its inflation hedge characteristics.

However, ISM PMI which measures the health of US manufacturing is below 50, meaning it is in contraction. It is not just under 50, but PMI dropped further negative in February from a below 50 print in January. This should be interpreted as the economy worsening into a recessionary posture. VIX, the volatility measure for the US stock market, is rising, which we would also expect as the stock market gets more precarious. Lastly, the Valkyrie Bitcoin Miner ETF has had a horrible week. This is important because it represents a growing swath of bitcoin fundamentals including foundational investment and interest in bitcoin, as well as related companies like chip fabricators. All of these factors could also be good for the bitcoin price as it is increasingly being seen as a deflation/recession hedge, as well.

Investor Insights

Macro Sensitivity: Investors should be aware of Bitcoin's increasing sensitivity to broad macroeconomic indicators. As Bitcoin becomes more intertwined with global markets, its price movements may reflect broader economic trends, necessitating a more holistic investment approach that considers global economic conditions.

Mining Sector as a Bellwether: The performance of the Valkyrie Bitcoin Miner ETF provides valuable insights into the broader Bitcoin ecosystem, reflecting not just the health of mining operations but also investor sentiment toward the sector. A downturn here could signal broader challenges within the industry or a shift in investor confidence, which can be critical for anticipating Bitcoin's future trajectory.

Chart of the Day

A little bit different chart for today’s chart of the day. This is the Bitmex Premium and Discount, along with the Funding Rate relative to price. Bitcoin’s perpetual futures uses an underlying index price of many different exchanges to calculate the funding rate. The price on Bitmex’s perpetual futures relative to this index price is the premium or discount. If perps are above the market index price it is a premium, below it is a discount. The orange color is the funding rate, this is the cost to hold the prevailing contract. When it is positive, that means traders holding long contracts pay a slight fee to those holding shorts contracts every 8 hours, and vice versa. This keeps the perpetual futures market in balance.

Right now, we are experiencing both a huge premium on Bitmex perps, and also a significant funding rate. This level of premium corresponds with other previous tops (except for the most recent one in November). Price could continue higher briefly, but the risk of this being a temporary top according to the metrics above, and the fundamental forces of perps, is rising.

Bitcoin Magazine Pro™ Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support! Please consider leaving a like if you enjoyed this piece. As well, sharing goes a long way toward helping us reach a wider audience!

A pretty cool and useful piece of work

Please consider the possibility of generating online Market and Mining Dashboards.

Y'all are quite bearish.