Bitcoin is Ready for Post-Halving Bullish Continuation

Analyzing Bitcoin's growth readiness, highlighting a cooling derivatives market, global shifts toward safer assets, and a maturing on-chain environment post-halving

Introduction

Our data suggest a market fully reset from overbought conditions last month and ready for a renewed push higher. On-chain metrics are exactly what we would expect from the end of a mid-cycle adjustment. Price metrics show bullish trends are intact, while the derivatives market has moved back into balance from multiple fronts. Lastly, the global macro numbers are still agreeing with our forecast for economic slowdown pushing investors into safer assets, in the US and globally.

On-Chain Bitcoin Metrics Post-Halving

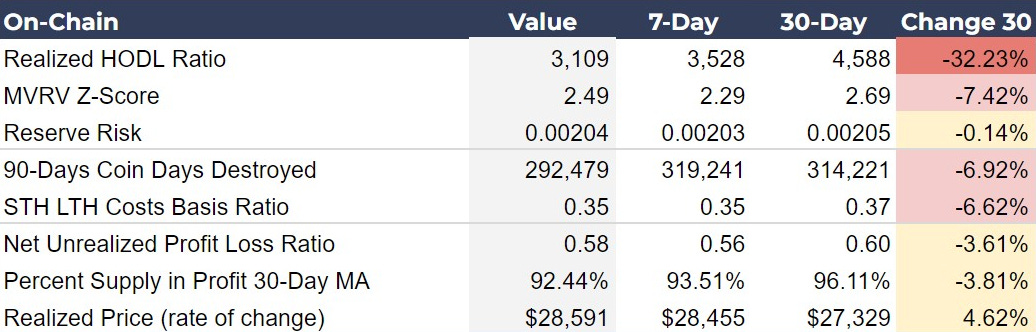

The first stat that jumps out is the Realized HODL Ratio, which has decreased significantly from 4,588 to 3,109 over the last 30 days, showing a substantial -32.23% change. This drop suggests that the tendency to hold Bitcoin has softened leading into the halving and could be quite bullish for the price as this trend reverses in the coming weeks.

The MVRV Z-Score is instrumental in identifying whether Bitcoin is undervalued or overvalued compared to its 'fair value,' which is calculated based on the realized cap. The decrease from 2.69 to 2.49 over the past month indicates that the market is cooling off slightly from a relatively higher valuation, moving closer towards what might be considered a fair or undervalued range according to this metric.

The movement metrics such as 90-Days Coin Days Destroyed, which has decreased by -6.92%, and the STH LTH Cost Basis Ratio, also down by -6.62%, both signify decreased movement of older coins and a cautious approach among both short-term and long-term holders. This aligns with the narrative of a mid-cycle correction where investors are possibly waiting for clearer signs of an upward trajectory post-halving.

The Realized Price metric, which has seen an increase in its rate of change to 4.62%, suggests a gradual increase in the average cost basis among investors, reflecting growing confidence in holding Bitcoin at higher prices. This is complemented by a slight decrease in the Percent Supply in Profit over the last 30 days, from 96.11% to 92.44%, a typical consolidation pattern following significant price changes.

INVESTOR INSIGHT

Strategic Entry Points: Given the decrease in the Realized HODL Ratio alongside the slight undervaluation indicated by the MVRV Z-Score, investors might find strategic entry points as the market digests the implications of the halving. The current metrics suggest a potential undervaluation phase, offering opportunities before the expected price climb due to the halving-induced supply shortage.

Bitcoin’s Price Dynamics

Bitcoin's recent price metrics show clear signs of a bullish trend as evidenced by the upward trajectory of its key moving averages over the past month. This includes a robust performance in short-term indicators like the 50-Day Moving Average, along with consistent gains in the 100-Day and 200-Day Moving Averages, confirming bullish behavior across multiple time frames.

The 200-Week Moving Average shows a modest increase, reflecting more stability and less volatility over a longer term, which aligns with a foundational strengthening in Bitcoin’s valuation.

On the volatility front, the Daily and Weekly Relative Strength Index (RSI) figures present mixed sentiments. The Daily RSI indicates a neutral market state, a change from recent lower levels, suggesting balance between buying and selling pressures. Conversely, the Weekly RSI has significantly cooled off from higher levels over the past month, indicating a normalization from previously overbought conditions.

Moreover, metrics like the Realized Price for Bitcoin have increased, indicating that the average price at which coins were last moved is on the rise—a bullish market signal. In contrast, the Short-Term Holder Realized Price has also shown an increase, whereas the Long-Term Holder Realized Price displays a slight decrease, suggesting that long-term holders were not as influenced by recent price peaks to sell their holdings.

INVESTOR INSIGHTS

Leveraging Moving Averages for Strategic Decisions: The significant upward trends observed in the key moving averages provide a solid foundation for trend-following strategies. Investors should consider these indicators for potential strategic entry and exit points, as they suggest continued bullish momentum.

Realized Price Stability and Holder Behavior: The rising Realized and Short-Term Holder Realized Prices suggest active trading at higher prices, signaling incoming capital and a bullish outlook. However, the slight decline in Long-Term Holder Realized Price is typical during bull markets, as long-term holders very slowly take exposure off the table.

Derivatives

The latest derivatives market data for Bitcoin suggests a notable shift towards balance following a period of extreme speculation, setting a more stable foundation for the continuation of the bull market.

Perps Funding Rate 7DMA Annualized: The sharp decrease to 0.22% from much higher rates over the last month indicates a significant reduction in the cost of holding long positions in perpetual futures. This reduction points to a cooling off from previously overheated leveraged positions, suggesting that the market excess has been corrected.

Futures Annualized Rolling Basis 3M 7DMA: The reduction in the futures rolling basis to 10.08% from previous weeks' higher values shows a calming of bullish speculation that had previously driven expectations to unsustainable levels. The easing of these futures premiums reflects a market that is less driven by speculative excess and more by sustainable trading behaviors.

Options 25 Delta Skew 1-Month: The decrease in this options market sentiment metric to a mere 0.18% from over 4% indicates a relaxation in hedging upside risk. Negative skew means options traders are hedging downside risk and vice versa for positive skew. Being near zero means a generally neutral stance, with a balanced view of risk among options traders.

Investor Insights

Reduced Downside Risk: This week’s continued decrease in both perps funding rates and futures basis confirms a trend towards reduced leverage and less speculative bullishness in the derivatives market. Investors appear more cautious, potentially reducing the risk of sharp price declines due to leveraged liquidations.

Foundation for Upward Momentum: The current neutral positioning in derivatives markets, coupled with a stable reduction in speculative excess, lays a robust foundation for potential upward price movements. As both perps funding rates and futures basis normalize, and options skew approaches a neutral stance, investors could look forward to a less volatile, more predictable rise in Bitcoin prices. The balanced risk assessment now seen across derivative metrics aligns well with the broader price stabilization, indicating that the market may be primed for a sustained bull run.

Global Macro Analysis

The macroeconomic data paints a picture of tightening liquidity and increasing caution in the global economic landscape. The decrease in Global M2 Money Supply and Global Central Bank Assets suggests a significant pullback in monetary expansion, which is often a precursor to a slowing economy. Such reductions typically indicate that central banks may be trying to curb inflation or prepare for economic downturns by reducing the money supply and pulling back from asset purchases.

The rise in the DXY indicates a flight to safety, as investors likely seek the stability of the U.S. dollar amidst global uncertainty, further supporting a recessionary outlook. The slight expansion in the U.S. ISM PMI Manufacturing indicates some resilience in manufacturing, yet it remains barely in expansion territory, which might not be sufficient to counter broader economic weaknesses.

The increased VIX points to heightened market volatility and growing investor anxiety, which are common in pre-recessionary periods as market participants react to uncertainty.

Overall, these indicators align with a prediction of sliding into a recession in the second half of 2024. They suggest a global macro environment characterized by caution, tightening liquidity, and an inclination towards safer assets, setting the stage for potential economic contraction.

INVESTOR INSIGHTS

Emerging Market Risks: As the U.S. dollar strengthens, emerging markets with significant dollar-denominated debt will face heightened financial stress. Investors should immediately consider safer investments or hedging strategies to manage currency risks. The downward economic spiral in these markets, characterized by domestic weakness leading to currency devaluation and increased dollar debt stress, calls for innovative solutions. Bitcoin could offer a strategic break from this cycle due to its non-correlated asset nature.

Spillover Effects: Economic slowdowns in key markets could significantly impact the U.S. economy, likely dampening global demand and disrupting supply chains. Investors should strategically diversify their portfolios to reduce these risks. Maintaining positions in resilient global assets like Bitcoin may prove beneficial, as it tends to attract increased demand as a hedge during times of global financial instability.

Chart of the Day

To support our analysis that we are nearing the end of a mid-cycle correction, where downside risk is diminishing and the potential for another bullish leg higher is increasing, let's explore the Pi Cycle Top Indicator.

Source: LookIntoBitcoin

Historically, the Pi Cycle Top Indicator has demonstrated remarkable accuracy, pinpointing all previous Bitcoin cycle tops within three days. It offers a straightforward visual cue, making it easily interpretable even for those new to technical analysis.

This indicator operates by overlaying two moving averages on a Bitcoin price chart: the 111-day moving average and the 350-day moving average, which is multiplied by two. The key signal occurs when the shorter moving average crosses above the longer, adjusted moving average, indicating a potential market top.

As the Bitcoin market continues to evolve, drawing in a new wave of institutional investors, the reliability of this indicator in future cycles remains uncertain. However, our current focus is not to predict a market top but to illustrate that we are far from reaching one. Even if the Pi Cycle Top Indicator becomes less precise this cycle, it's unlikely to deviate so significantly that it contradicts the entire history of Bitcoin's market behavior. Thus, the evidence suggests we are experiencing a mid-cycle correction, aligning with broader historical patterns.

Bitcoin Magazine Pro™ Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!