Bitcoin Halving 2024: A Turning Point for Miners and Market Dynamics

Exploring the Impact on Mining Operations, Network Traffic, and Economic Shifts in the Bitcoin Ecosystem

Intro

As Bitcoin inches closer to its much-anticipated halving event, the air is thick with speculation and anticipation. This blog post peels back the layers of the Bitcoin ecosystem's current state, exploring how miners brace for change, how network traffic adjusts in response, and what these shifts mean for the broader economic landscape. Join us as we navigate through these transformative times, providing a detailed narrative on the complexities that shape the future of Bitcoin in a post-halving world.

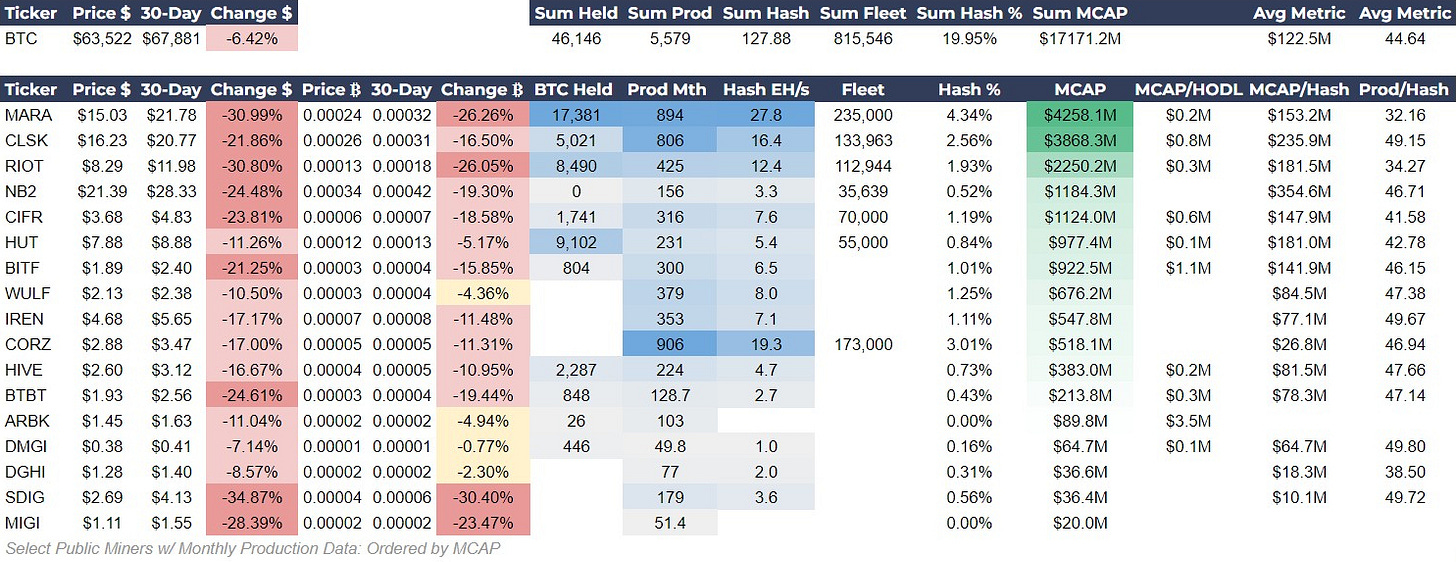

Public Miners: Breakthrough or Breakdown

The Bitcoin miner route continues. Most of the companies observed have experienced notable price declines over the past 30 days in both USD and bitcoin terms. For instance, the largest miner, Marathon (MARA), saw its price drop by over 30% in USD and 26% in bitcoin terms. These trends mirror the broader market's consolidation, fueled by uncertainty surrounding the upcoming halving and rampant speculation by mainstream media. The narrative spun around this event suggests it could bring a major shakeup, potentially leading to the extinction of less resilient miners.

Despite the grim predictions, miners’ share prices are expected to recover post-halving as uncertainty gives way to optimism and price appreciation for bitcoin. Today’s market moves might already be hinting at this possible turnaround. For instance, the share prices of major companies have surged by 4-5%, suggesting that investor confidence may be rebounding as the halving event transitions from a looming threat to a passed milestone.

Investor Insights

Halving and Production Updates: We are currently mid-month, so public production and revenue numbers will not be updated until 2-3 weeks after the halving. In this period, miners with higher bitcoin reserves should be perceived in a better light by the market.

Expansion Plans: Most miners are either just completing or in the middle of massive expansion plans. RIOT, for example, recently energized part of their new facility in Navarro County, Texas. They are on track to increase their hash rate by nearly 150%. Companies with large reserves and expansion plans have the potential to outperform rivals or even spot bitcoin.

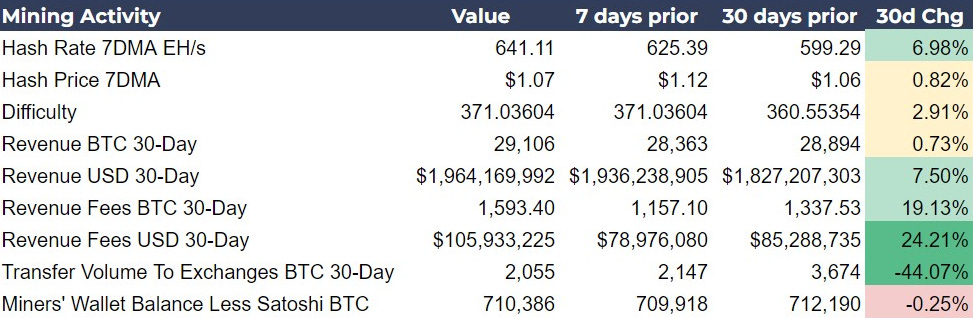

Mining Adjustments Amidst Bitcoin Halving

The hash rate, measured over a 7-day moving average, has increased by approximately 7% from 599.29 EH/s a month ago to 641.11 EH/s. This rise indicates optimism from miners despite the FUD surrounding the halving. They are gearing up for the post-halving competition, likely anticipating a spot price rise.

Revenue metrics present a mixed but overall positive picture. Bitcoin mining revenue over the past 30 days increased slightly by 0.73%, while revenue in USD terms saw a more substantial rise of 7.50%, despite a slightly lower spot price of bitcoin. Particularly notable is the increase in revenue from fees (in both BTC and USD), which surged by 19.13% and 24.21%, respectively. This is due to more urgent, fee-insensitive transactions around the uncertainty of the halving.

Conversely, the transfer volume of bitcoin to exchanges has dropped by 44.07% over the past month. That is a significant drop in the context of the halving reduction right around the corner. Miners' wallet balances have decreased slightly by 0.25% over 30 days, but have again increased on a 7-day timeframe.

Investor Insights

Business as Usual: The halving is an interest time, especially for new Bitcoin investors. It is understandable to view it as a major stumbling block that would make miners and investors hesitant. However, as we can see in the data, bitcoin continues to grow and miners are confident.

One-way Function of the Halving: The hoarding behavior incentivized by the halving is then reinforced by the halving in a one-way function of tightening supply. Deflationary pressure quickly outweighs any temporary revenue concerns.

Network Traffic: Transaction Economics and Dynamics

Mempool: The mempool has experienced a growth of 6.94% over the past month, with its size increasing from 216 MB to 231 MB. This growth is most pronounced in the mid-tier fee level, indicating a balanced increase in network activity where users are prioritizing a cost-effective yet timely processing of transactions. Although there has been some growth in the higher fee tier, it's the mid-tier that reflects a broader user engagement with the network, suggesting an increase in regular transactional activities.

Transaction Fees: A dramatic shift is observed in the fee structure, particularly in high-priority fees, which have skyrocketed by 711.32% over the last month, from $1.59 to $12.90. This stark increase was even more pronounced a week ago when fees peaked at $21.71. Such a drastic rise in transaction fees, especially for high-priority transactions, points to a surge in demand for faster transaction processing. This could be due to a variety of factors, including speculative trading activities, increased usage of the network, or large, urgent transactions needing quick confirmations.

Inscriptions: The significant increase in inscriptions, which are up by 87.47% to 108,711 in the past 30 days, highlights a growing speculative interest in Bitcoin again around the halving. This surge suggests that retail traders, historically more interested in altcoins, are now engaging with Bitcoin in innovative ways. Inscriptions serve as a gauge for retail sentiment and speculative appetite, contrasting with institutional behaviors such as ETF flows, which typically represent more conservative investment strategies.

Investor Insights

Rising Fees vs Spiking Fees: High fees are typically used as a criticism of Bitcoin, however, rising fees specifically indicate rising demand for bitcoin transactions. There is a difference between rising fees (gentle increase over days and weeks) and spiking fees ( a 24-hour period of rapidly rising fees). Spiking fees typically indicate volatility in the near term, as people are all of a sudden urgently trying to move their coins (see chart below).

Inscription Activities Around the Halving: Inscribers are gearing up for the halving, targeting the first block of the new reward epoch and the last of the current epoch. This anticipated increase in inscriptions could temporarily swell the mempool and elevate transaction fees. Although this activity is expected to introduce some price volatility, the effects should be short-lived.

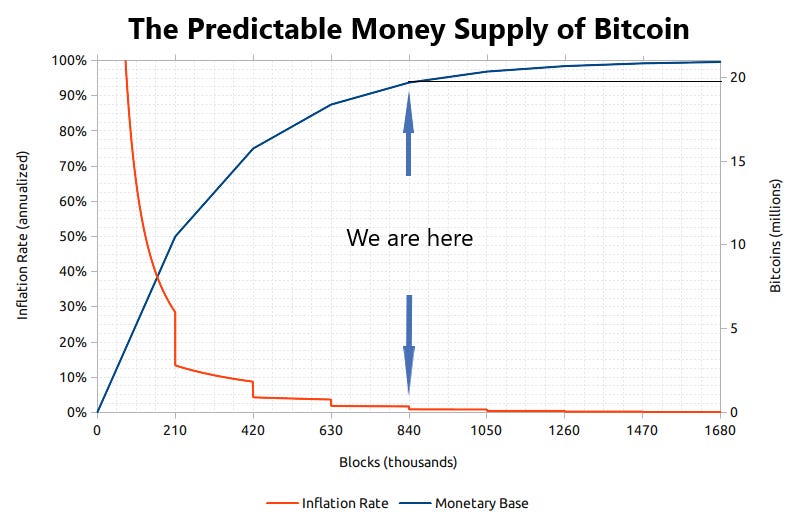

Chart of the Day

Happy Bitcoin Halving! This is an absolutely unique event in human history. Never before has there been an asset like bitcoin, who’s issuance decreases with age and can never increase despite any amount of rising demand. It is a truly decentralized monetary asset. The independent halving event is so difficult to establish and maintain, all others who have attempted a purely independent process and monetary token have failed.

93.7% of bitcoins have been mined

1.3 million left to go

Source: Modified from bitcoinblockhalf.com

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

THE BIGGEST CELEBRATION IN BITCOIN

THE BITCOIN HALVING LIVESTREAM BEGINS AT BLOCK HEIGHT 839,979 ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!