Bitcoin Fundamentals & Purpose

How Bitcoin was born to end reliance on broken systems and deliver the world’s first truly scarce digital money

Bitcoin was created in the ashes of the 2008 financial crisis as a peer-to-peer electronic cash system requiring no trusted third parties. Satoshi Nakamoto’s innovation solved a problem cryptographers had been attempting to solve for decades by creating the first secure digital money that could not be counterfeited, duplicated, or controlled by any single entity. Understanding Bitcoin requires grasping both its revolutionary technology and its role as the world’s best form of money ever created.

Bitcoin’s Purpose

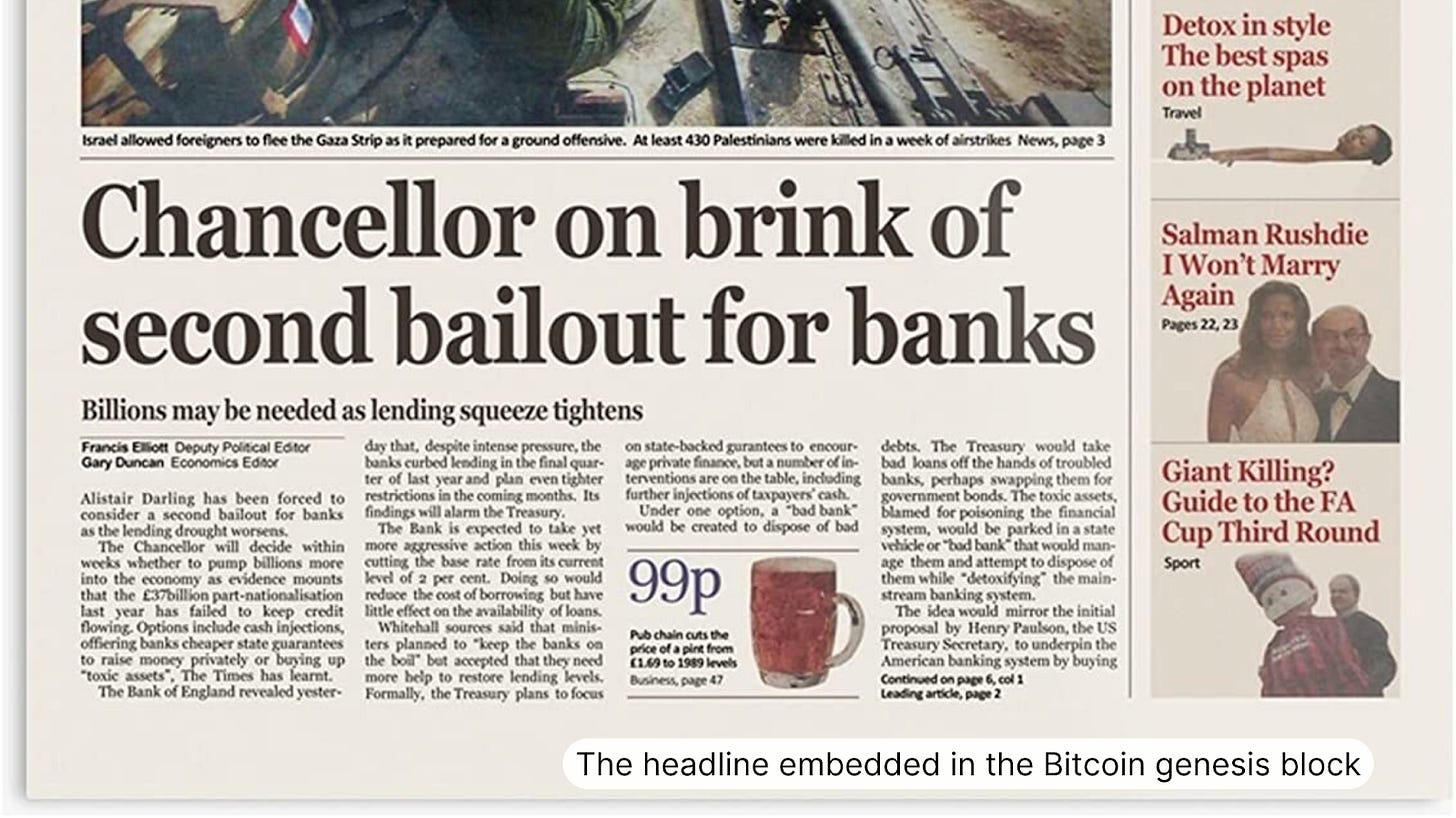

Bitcoin was born on January 3rd, 2009, when the Genesis block was mined, bringing the first bitcoin into circulation. Satoshi left a message in this block that perfectly captures Bitcoin’s purpose: “Times January 3rd 2009 Chancellor on brink of second bailout for banks.” Bitcoin was created to provide an alternative system of monetary transactions that did not rely on central parties or intermediaries that could dictate transactions and control lives.

Figure 1: The headline from The Times newspaper, January 3rd, 2009.

Bitcoin represented the culmination of decades of work attempting to create a digital currency by cypherpunks (those seeking to use encryption to protect personal data, communications, and finances from government and corporate intrusion). Previous attempts, such as Hashcash in 1997, came close, but Bitcoin was the first to truly succeed and fulfill all the necessary criteria for functional money. The code was fully open source, released on GitHub, allowing anyone to verify, audit, and use Bitcoin however they want.

Fixed Supply

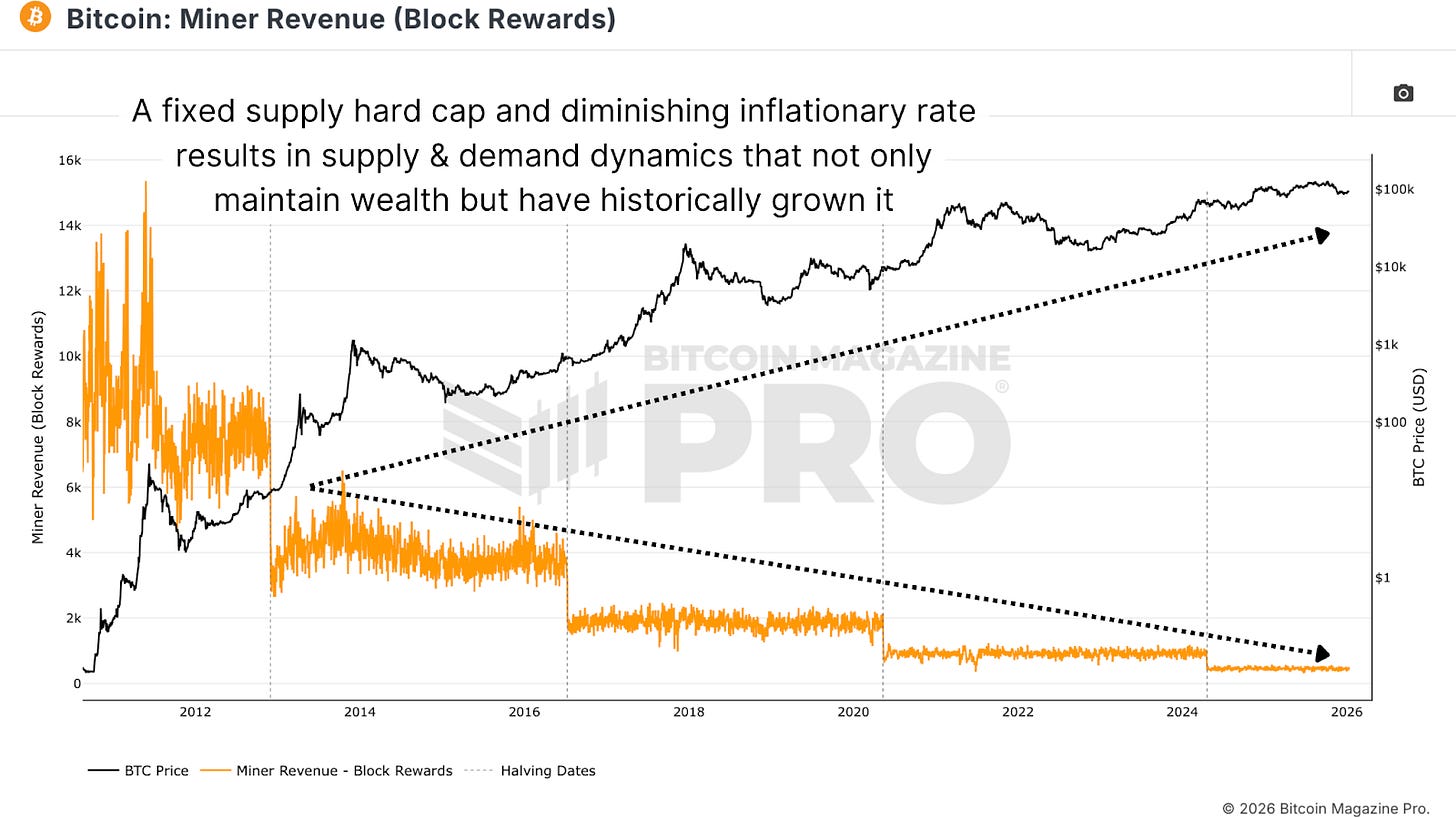

Bitcoin’s defining characteristic is its fixed supply. There can never be more than 21 million bitcoin created. It is hardcoded into the software itself. Bitcoin cannot be printed, found on asteroids, or discovered underground. This is not a linear inflationary rate but one that decreases roughly every four years through the Bitcoin halving event. In Bitcoin’s early years, approximately 10 million bitcoin came into circulation. Over the next four years, only 5 million more entered circulation. Then 2.5 million. Then 1.25 million. This diminishing inflationary rate means the last fraction of a bitcoin will not enter the network until approximately 2140, over a century in the future.

Figure 2: Bitcoin’s periodic halving events limit supply and inflation.

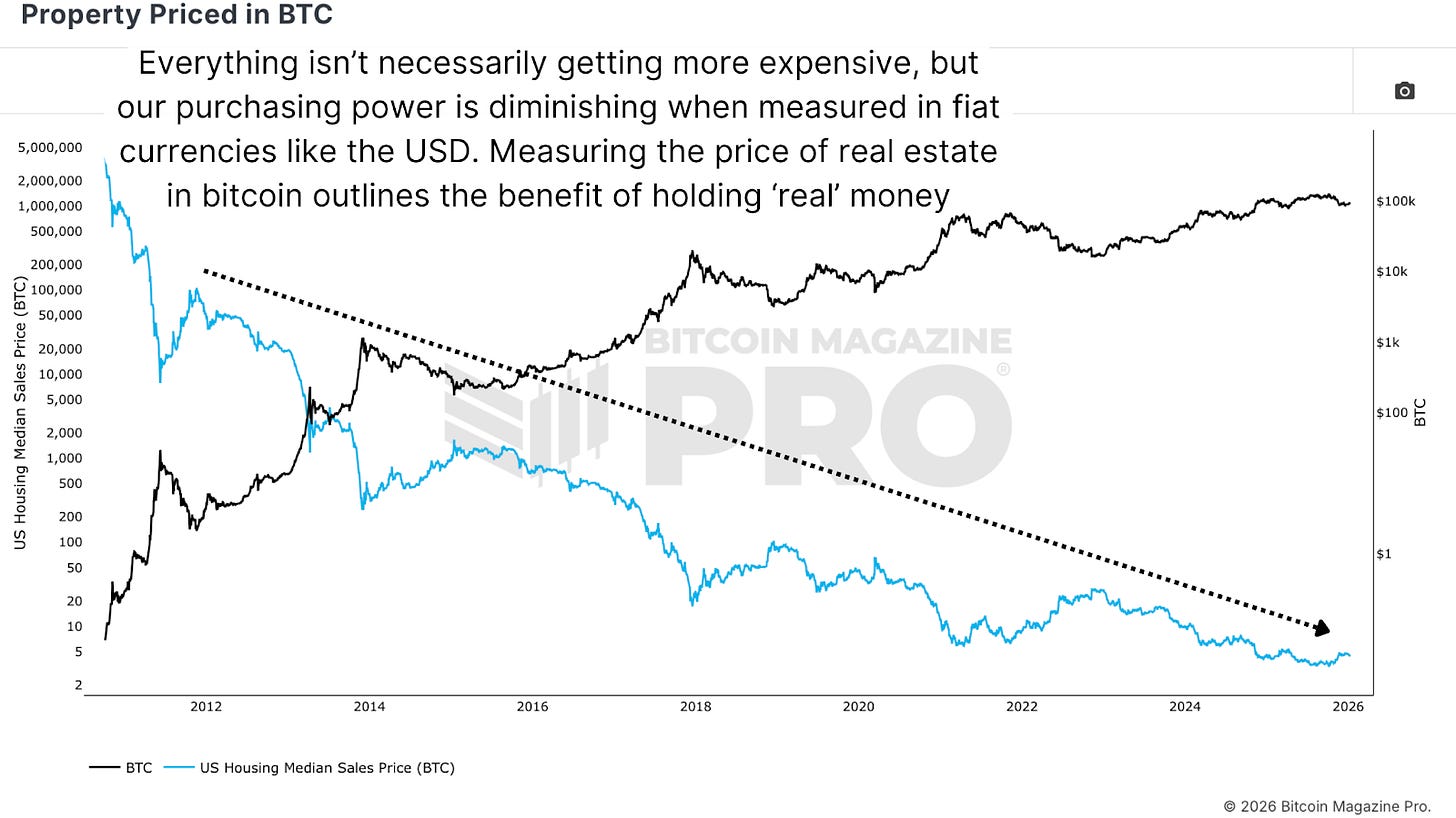

Bitcoin’s scarcity creates purchasing power that increases over time. If you bought gold years or decades ago and buried it, that gold bar would buy you roughly similar goods today (maybe a little more, given its recent meteoric rise!). If you buried dollar bills, they would buy significantly less. Real estate measured in US dollars shows house prices rising substantially, but measured in Bitcoin, house prices are decreasing very rapidly. Bitcoin does not just retain purchasing power; it increases it.

Figure 3: The value of US property measured in BTC has eroded over time.

The Solution

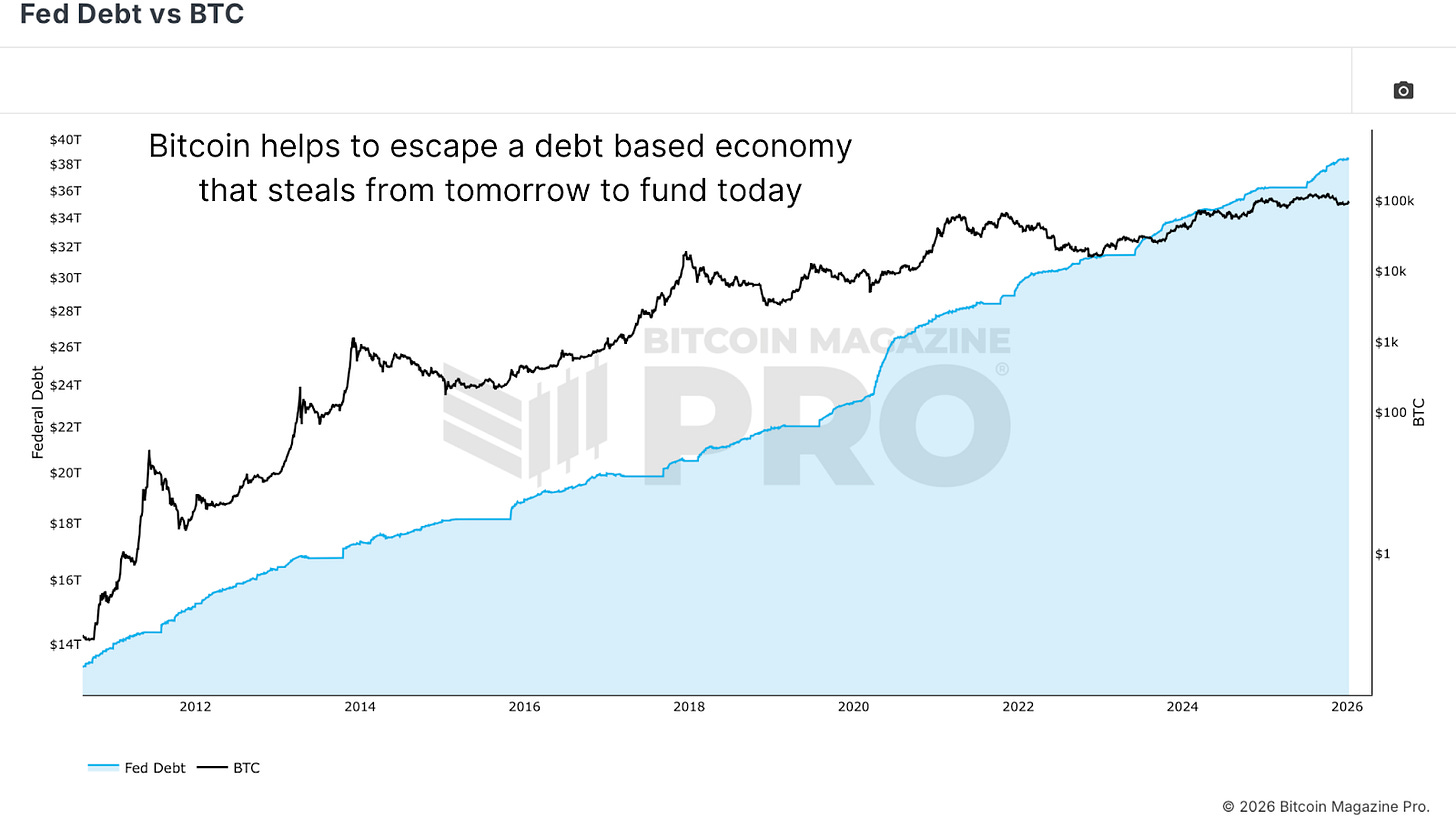

The current monetary system is debt-driven and unsustainable. The US Federal Debt exceeds $38 trillion, while circulating US dollars total around $22 trillion. This is robbing wealth from future selves by making tomorrow pay for today. This is not fair. The work people put into securing wealth and earning energy is diminishing as purchasing power decreases through inflation.

Figure 4: The ever-increasing volume of US Federal Debt.

Bitcoin solves this problem. Bitcoin is not printing itself. It is not issuing debt. It is not stealing from the future. It is maintaining and increasing purchasing power throughout time. Gold has performed well as people seek inflation hedges. But Bitcoin, by eliminating the possibility of inflation through its fixed supply, represents the ultimate solution to currency debasement.

Conclusion

Bitcoin’s value ultimately derives from it being energy turned into a commodity in ways never seen before. It represents the best money the world has ever seen because it fulfills all monetary requirements while being controlled by no entity, having perfect scarcity, and operating transparently. As Satoshi’s white paper declared, Bitcoin is a peer-to-peer electronic cash system designed to function without institutional intermediaries. That remains Bitcoin’s revolutionary purpose.

For a more in-depth look into this topic, watch our most recent YouTube video here: Bitcoin Masterclass #1 | What Is Bitcoin

Matt Crosby

Director of Research & Analytics

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else.

We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Good BTC fundamentals recap, but market structure often dominates: leverage, positioning, and policy/regulatory shifts can overwhelm “sound money” narratives for weeks/months. The long-term idea can be true while the path remains messy.

Bitcoin Magazine Pro — a publication that profits from Bitcoin adoption — tells you Bitcoin is "the best money ever created." Remember: if they're selling it, the math tilts in their favor, not yours. Wall Street didn't suddenly develop a conscience. Where are the customers' yachts? https://www.mecrankyoldguy.com/p/bitcoin-in-your-401k-where-are-the