Bitcoin Breaks Out: Analyzing the Market's Renewed Bullish Momentum

In-depth Insights into On-Chain Metrics, Price Trends, Derivatives Market, and Macroeconomic Indicators Signaling a Strong Bitcoin Rally Amidst Global Economic Shifts

Introduction

This week's analysis reveals a significant renewed bullish momentum and cautious hedging strategies among traders. On-chain metrics indicate that Bitcoin has passed the bottom of its consolidation phase, while price and derivative market indicators show increasing confidence. However, macroeconomic signals continue to point towards potential recessionary risks. Let's delve deeper into these key metrics and understand their implications for Bitcoin investors.

On-chain Signals for Bitcoin

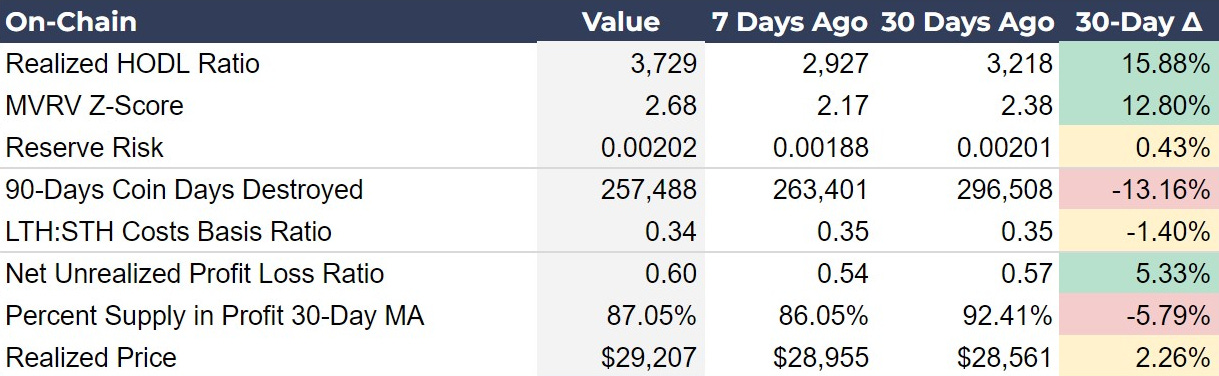

The on-chain metrics suggest that Bitcoin has passed the bottom of its consolidation phase, with indicators like the Realized HODL Ratio and MVRV Z-Score pointing to renewed bullish momentum and increasing confidence among long-term holders. Despite recent price fluctuations, the overall market sentiment is improving, setting the stage for the next leg of the bull market.

The Realized HODL Ratio, which compares the realized price of 1-week old UTXOs to 1-2 year old UTXOs, has made a notable reversal. This metric's change in direction, combined with Bitcoin's price breaking significant levels like the 50 DMA, indicates a strong signal of the end of the consolidation phase. Although it has not reached its previous cycle high of ~7,750, the current upward trend aligns with price breakout, reinforcing the bullish sentiment.

The MVRV Z-Score, calculated as (market cap - realized cap) / standard deviation of market cap, has shown a positive trend, bottoming out before the Realized HODL Ratio and continuing to rise. This metric signals overvalued or undervalued conditions in the market, with its current increase indicating that Bitcoin is perceived as undervalued. The direction of the MVRV Z-Score reflects market sentiment, where a rising score suggests improving sentiment and a potential undervaluation phase, contrasting with a declining score during consolidation that signifies temporary overvaluation for that cycle phase.

90-Days Coin Days Destroyed, measured as the number of coins spent multiplied by the number of days since they’ve been spent, continues to decline this week. This signals increasing holding behavior.

The LTH:STH Cost Basis Ratio started moving again this week, indicating a resumption in bullish price movement. Declines in this metric are what we expect in LTH are winning and slightly distributing coins. Since the LTH cost basis doesn’t move very much in explosive bull markets, it is the STH cost basis that rises rapidly, this metric will fall as the bull market resumes. The end of the bull market is typically marked by this ratio being below 0.2, so we have a long way to go.

Investor Insights

Broad agreement among on-chain metrics: Most of these metrics give an approximate position within the broad 4-year bitcoin cycle. Right now, we are not at extremes in any of them, suggesting we are comfortably in the middle of the cycle. None of these metrics are “misbehaving” either. They are acting as we expect in the 4-year cycle, which is encouraging and means we can likely rely on them when they are signaling a cyclical top.

Price Metrics

Last week, I highlighted the 50 DMA as being the primary level to break to signal resumption of the bull market. Price sliced right through it, and is now comfortably above all moving averages. Every metric in our price section other than the recently added Hash Ribbons is squarely bullish.

Hash Ribbons have crossed bearishly as warned about last week, meaning the short term average for hash rate is below the long term average. This typically coincides with large bearish price movement, but in this case, it also happens after halvings. The halving temporarily decreases the dollar value of the block subsidy, forcing a segment of inefficient miners to turn off their hash rate until the price rises enough to make them profitable again. In other words, this metric is working exactly as expected at this point in the cycle.

Investor Insight

Weekly RSI is crossing back into overbought territory, which historically happens at the beginnings of big bull market moves. Weekly RSI of 80+ is the point at which the risk of a significant pull back outweighs the potential upside left in the move.

Derivatives Market Numbers

The derivatives market shows a mix of bullish positioning and cautious hedging. The increase in the Perps Funding Rate and the Futures Annualized Rolling Basis indicates that traders are optimistic about Bitcoin's immediate near-term price action. However, the sharply negative Options 25 Delta Skew suggests that options traders have increased their downside hedging, typically interpreted as being more pessimistic. This could be due to approaching resistance at previous ATHs or uncertainty over the ETH ETF approvals.

Perps Funding Rate has increased slightly WoW and significantly over the past month, indicating a growing optimism and bullish sentiment among traders. The higher the funding rate goes the more bullish market sentiment gets.

Futures Annualized Rolling Basis is also rising slightly, indicating increasing expectations for future price rises. This number is the difference between spot and a futures contract expiring in 3 months. IOW, traders can buy spot bitcoin and simultaneously sell a futures contract expiring in 3 months and capture this spread of 10%. It increases as the quarterly futures contract increases due to expectations of future price gains.

Investor Insight

Leverage is starting to come back to the market. After last week’s update where I said it looked as if traders were coming back into the market after a post-halving pause, this week they are starting to establish positions and increase leverage slightly. We might not break straight through to new highs, but the potential for a strong spike in price is rising.

Perps Funding Rate is right near the 50 percentile for historic back-tested range. That means it can get a lot more bullish. When this number gets to 25-30% it is time to pay attention for a large deleveraging correction.

Macro Metrics Affecting Bitcoin

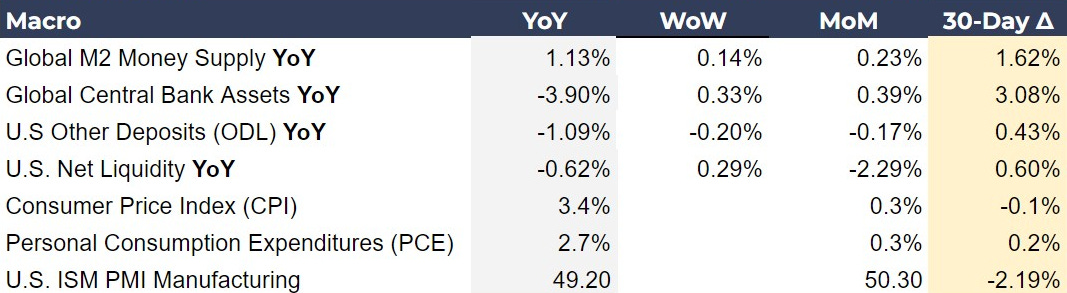

The consensus measures of liquidity in the financial system, M2 Money Supply and Central Bank Assets, are beginning to turn positive as seen in the WoW and MoM numbers, signaling an end to the globally synchronized tightening cycle used to halt consumer price rises. However, more modern measures of the money supply like ODL and Net Liquidity are falling.

Other Deposits ODL is a recently added metric that appears on the Federal Reserve's H.8 report that comes out every Wednesday. It is a more narrow version of M2 that does not include currency or retail money market funds. These are taken out to focus on high-powered, more impactful money. We typically do not use cash for very large economically significant payments, and money market funds do not act as a medium of exchange.

ISM PMI has been in contraction territory for 17 of the last 18 months. Only March was positive at 50.30. Since manufacturing is often a leading indicator of economic performance, continuous contraction in this sector can signal broader economic troubles.

Investor Insight

Overall, our macro metrics are still signaling a coming recession starting later this year or first half of next year. Bitcoin should benefit in this pre-recession period because it is a hedge against the deflation of a recession with no counterparty risk, and a hedge against the inevitable government response of large deficit spending.

Bitcoin Magazine Pro™ Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!