Bitcoin Breakout Confirms Recession

Recession is coming, Bitcoin performs as a flight to safety

This week’s topics:

Bitcoin spikes, where does it go from here?

Bitcoin and Macro confirm recession

China capital outflows

Bitcoin Smashes Through Resistance

We did it fam! We broke the resistance at $31,000!

The last two days have been exhilarating for long-term bitcoin holders, those who have lived through the hardest bear market in Bitcoin history, but it is time to get onto the next trade. Where does bitcoin go from here?

Yesterday we received two pieces of news about the Bitcoin spot ETFs. First, BlackRock’s filing was updated to include their “seeding” of the ETF. Seeding is when applicants contract a third-party to preemptively create shares to prepare for launch. Yes, that includes buying bitcoin.

Source: Filing and tweet

Second, the IBTC ticker was assigned on the DTCC product listing. DTCC is the corporation that provides settlement and clearing for all US equities. Confusion ensued when a parody account claimed the ticker had been revoked.

What should we expect in the next week or two? This section will be chart heavy, followed by more narrative driven sections below. These are some standard charts I publish to members on bitcoinandmarkets.com.

The first chart to look at is the Fibonacci retracement levels. Bitcoin has always hit the Golden Pocket retracement for the previous bear market, PRIOR to the halving.

Volume-by-price highlights the same level of $48k, adding confirmation to historical performance. In the context of the ETF approval, that target is possible by the end of year.

The Ichimoku Cloud with extended settings is an indicator pioneered years ago by Josh Olszewicz. Standard cloud settings are extended approximately 100% to accommodate bitcoin's 24/7 trading hours. Below, the flat top of the cloud acts like a magnet for price, representing a return to the mean of the foregoing period. The top of the cloud here matches with the 50% retracement in the Fib chart above. An Edge-to-edge (E2E) trade is a common strategy in Ichimoku. If a candle closes in the cloud it often leads a move across the cloud. In our setup, the flat top combined with an epic E2E is quite powerful.

Heading to short-term charts, the daily RSI hit extreme overbought territory not seen since January. Typically, when this overbought, momentum slows. Price can drift upward while RSI drifts down, forming a bearish divergence (see January). We won’t repeat exactly, of course, but the overbought conditions mean the explosive move is over for the time being.

After the 2019 pump and COVID crash, price broke out above previous highs on similar RSI. Back then, it took another 80 days to continue the breakout. I don’t think it will take that long this time with the ETF imminent, but we are likely looking at a week or two of slower prices.

All-in-all this breakout is unquestionably bullish, however, it is likely overdone in the near-term. We must add a caveat for the ETFs. If approved, all bets are off and we’ll reassess at that time.

Bitcoin Spike Confirms Headed for Recession

One of the most widely held misconceptions in Bitcoin is that it is primarily an inflation hedge. Seen through that lens, one would expect this spike in bitcoin to imply money printing heating back up. However, all signs are the opposite.

Private bank credit represents true base-money in our economy. It’s shrinking. If bitcoin is only an inflation hedge, we would expect falling prices.

Source: FRED

Recessions are deflationary. The inflation narrative says that if bitcoin is pumping, inflation is back, but instead currently deflationary pressure is all around us. How do we square that circle?

Bitcoin is primarily a deflation hedge in this environment, the tail-end of a great credit cycle in the Ray Dalio sense. It is an inflation hedge, too, but not now. The investment thesis was clearly articulated by Bitcoin’s Chief Marketing Officer, Larry Fink of BlackRock, namely that Bitcoin is a safe haven against recession.

Gold is getting the same safe haven bid. After a brief disruption, driven by dynamics in China, bitcoin and gold are once again in sync.

Oil continues to slump, signaling demand is low enough to outweigh the OPEC+ production cuts (-4.6 million bpd) and war in the Middle East. For example, September was a 26-year low for gasoline demand in the US.

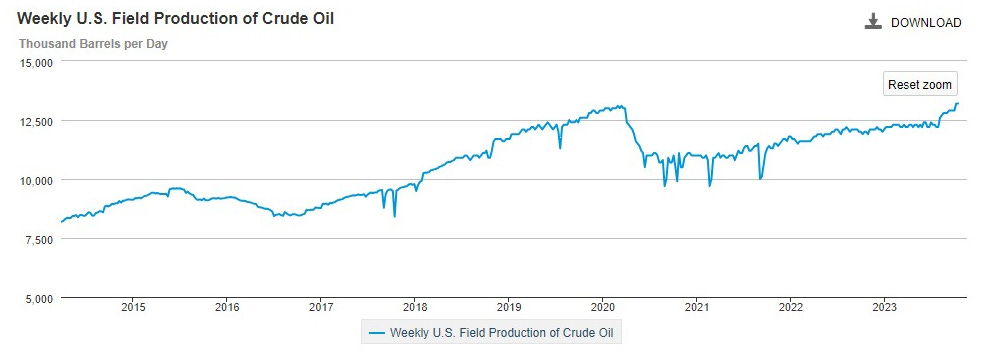

Demand is cratering as the US reaches an all-time-high production of 13.2 million bpd. OPEC will have to cut more if they want to keep prices elevated.

Source: EIA

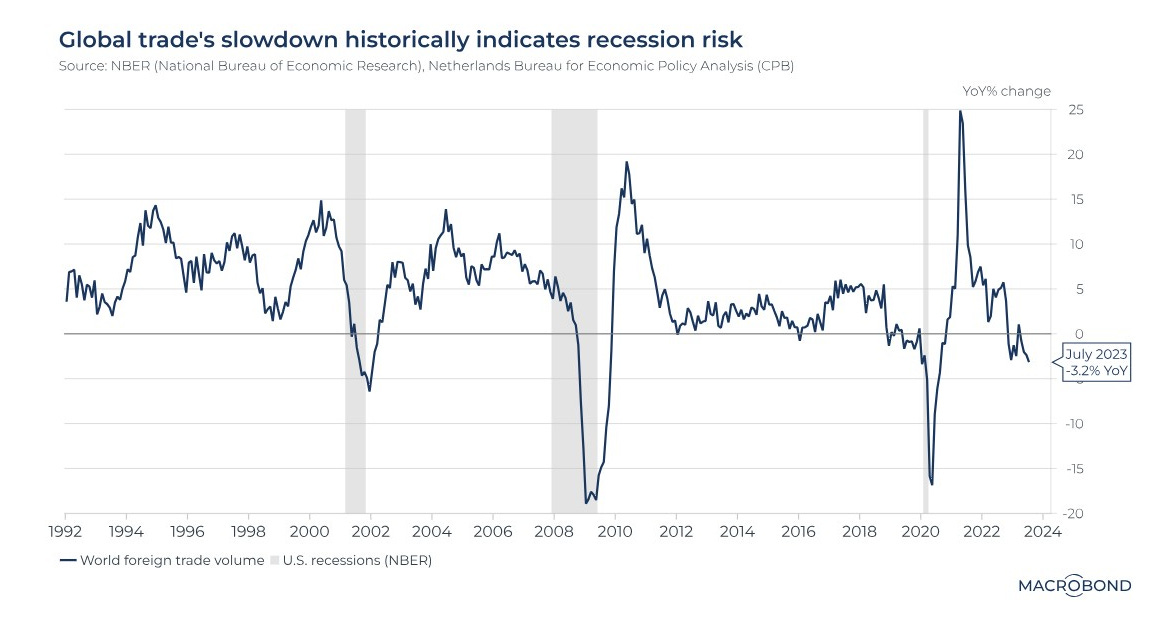

Global trade is also slowing, which is not good for global demand or credit markets. Who wants to lend in this environment? No one.

Source: Macrobond

What about government spending, isn’t that inflationary? Government spending trades a more productive private economy for less productive government spending and investment.

The Fed isn’t pumping either, it’s raised rates 4 times this year and reduced its balance sheet from $8.5 trillion to $7.9 trillion (-7%). Despite all that deflationary pressure, bitcoin is up over 100% YTD. Let that sink in.

An inflationary lens would lead you to sell your bitcoin today, because deflationary tides are everywhere. Don’t do that, bitcoin is a safe haven in a deflationary recession.

Xi Visits the People’s Bank of China (PBOC)

Chairman of the Chinese Communist Party (CCP), Xi Jinping, has visited the PBOC for the first time in his career. According to Reuters:

Xi, along with Vice Premier He Lifeng and other government officials, visited the People's Bank of China (PBOC) and the State Administration of Foreign Exchange (SAFE) in Beijing on Tuesday. [...] The purpose of the visit was not immediately known.

This visit comes on the day that the Chinese legislature passed the anticipated 1 trillion yuan ($137 billion) investment plan, allowing China’s fiscal deficit to rise to 3.8% of GDP from the 3% level set in March. From Bloomberg:

China has rarely adjusted the budget mid-year, having previously done so in periods including 2008, in the aftermath of the Sichuan earthquake and in the wake of the Asian financial crisis in the late 1990s.

This move goes against Xi’s well-known plan to transform China from an export-dependent economy to a consumer-led one. Xi had planned to use pain to force economic realignment. This new investment package, however, is a return to the old infrastructure-first model and thus losing face for Xi.

Visiting SAFE shows concern for the currency, down 5%+ against the dollar this year. Massive capital outflows in September, the largest since 2016 at $75 billion, are also unacceptable.

Import/exports is down 10% in dollar terms, the real estate sector is collapsing, the yuan is down 5% against the dollar, capital is fleeing, not to mention a demographic crisis precludes actually achieving a consumer-led economy. While it doesn’t look good for China, this could be the perfect storm for Bitcoin. Bitcoin is the perfect capital flight tool, just look at 2016: The last time capital outflows were this high, bitcoin embarked on the monster 2016-2017 rally.

We need more of your analysis on the Pro platform. Pass my comments to BM. Thanks.

Let's go then! 🚀