Analyzing Bitcoin’s Current Correction and Future Forecasts

Exploring the Impact of Recent Corrections, Market Divergences, and Projected Growth in the Bitcoin Landscape With Near, Medium and Long Term Forecasts

Introduction

Today’s post is going to be a typical Premium post from Bitcoin & Markets. I will go discuss the current situation with the Bitcoin price and then give my near-term, medium-term and cycle forecasts. You can receive these updates regularly at bitcoinandmarkets.com.

Current Situation

The current correction has reached -27% from the new ATH of $73,794 set on 14 March. Price is currently under the 200-day MA for the first time since October ‘23. Anytime bitcoin is below the 200-day MA it is a great buying opportunity. We are also forming a bullish divergence that will lock in with the next positive candle.

Price tested structural support formed in February after the first period of the ETFs. The next support lower is the ETF launch level itself around $49,000.

This is the first 25%+ correction in 427 days, the longest ever without a 25% correction in Bitcoin history.

Source: caprioleio

This cycle is also still well ahead of schedule based on the previous cycle ATH. There is some fudge factor in this metric if we consider that the prior cycle was artificially suppressed due to leveraged Defi shenanigans and FTX’s paper bitcoin fraud. If we extend last cycle’s high to $100k, as some suspect should have been the blow-off top, we get a green line for this cycle right in the 60% pocket matching previous cycles.

Source: IntoCryptoVerse

We can also look at the performance based on halvings, and this is the worst performing cycle yet. This could mean that we are set for make up ground in the next several months.

Source: Pierre Rochard

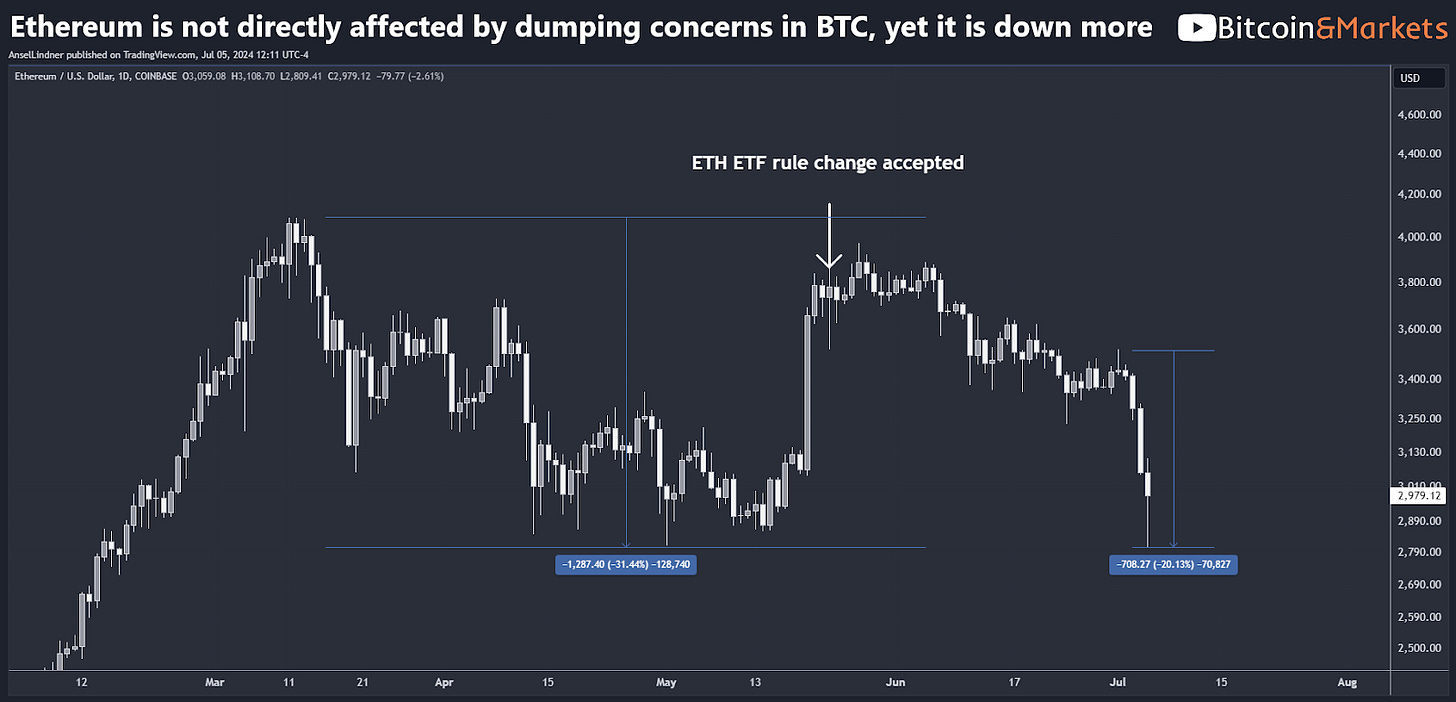

Where is the selling coming from? The consensus speculation is the price dip is coming from the German government dumping approximately 10,000 BTC and the pricing in of MtGox creditor distributions. However, Ethereum price action seems to contradict this view. Ethereum is not affected by either of those factors and even has a potentially bullish catalyst in the launch of spot ETFs, yet it is falling more than bitcoin.

ETH dropped 31% from its high on 12 March of $4093. Since the temporary bounce high on 1 July, Ethereum is down 20% to Bitcoin’s 16%. The ETHBTC pair is down more than 7% since the recent high on 28 June.

Overall, this is a painful sell off for Bitcoin but it is not out of the ordinary. It is extremely difficult to hold bitcoin long term, contrary to how many people from the outside picture it. Also, of importance is the number of days without a 25% drawdown shows that bitcoin is becoming less volatile as it matures. For years, bitcoiners have been saying that as bitcoin becomes more widely adopted, it will naturally become less volatile, and that finally appears to be playing out.

Near-term Bitcoin Forecast

My near-term forecast covers the next two weeks. As you can see below, there is massive resistance above the price with the gray rectangle showing the cluster of the strongest resistance. Price is already bouncing nicely off the lows and edging near the 200-day MA. Once we break that, it is on to the 20-day.

The size of the 4th of July flush is historic. It was the largest day of liquidations since the FTX collapse in November ‘22. Bigger even than the August ‘23 flush, providing very fertile soil for a bounce to take hold and rally into near term resistance levels.

Source: AXELXBT

The 4-hour chart is also looking like a bottom, with bull div off of extremely oversold conditions. I left the gray rectangle from the daily chart for reference.

For the short term forecast, I expect the bottom is in, based on liquidation levels, bullish divergences off extremely oversold conditions, and fitting the mold of a typical bull market correction. The 200-day will be the first major level to overcome at $58,500, followed by the 20-day at $62,000. Price may threaten the cluster of resistance at $65,000 next week. Downside risk is limited due to oversold conditions and the overestimation of net sell pressure.

Medium-term Bitcoin Forecast

My medium-term forecasts cover up to 6 months. This nicely takes us to the EOY and post-US election. The wild card in this timeframe is the possibility of recession. It is still my position that we are likely to enter an official recession in the second half of this year for the myriad of reasons I’ve stated in previous posts, specifically calling the current environment a pre-recession period.

Pre-recession periods are dominated by stocks doing very well, bond yields generally falling, and safe haven assets like Bitcoin and gold getting bids. All those things have happened over the last year. The current pre-recession period is being buoyed by deficit spending in the US, at the rate of $1 trillion every 90 days. The delay of the recession could get more support by releases from the Strategic Petroleum Reserve (SPR) in the lead up to the US elections.

That being said, Bitcoin’s market should not be affected negatively by macro events until an acute market crash, if and when it comes.

Bitcoin has diverged from stocks for the first time this bull market, resembling 2019. Back then, bitcoin reversed and caught up to stocks, followed by the market singularity of the COVID crash, which is unlikely to reoccur this time.

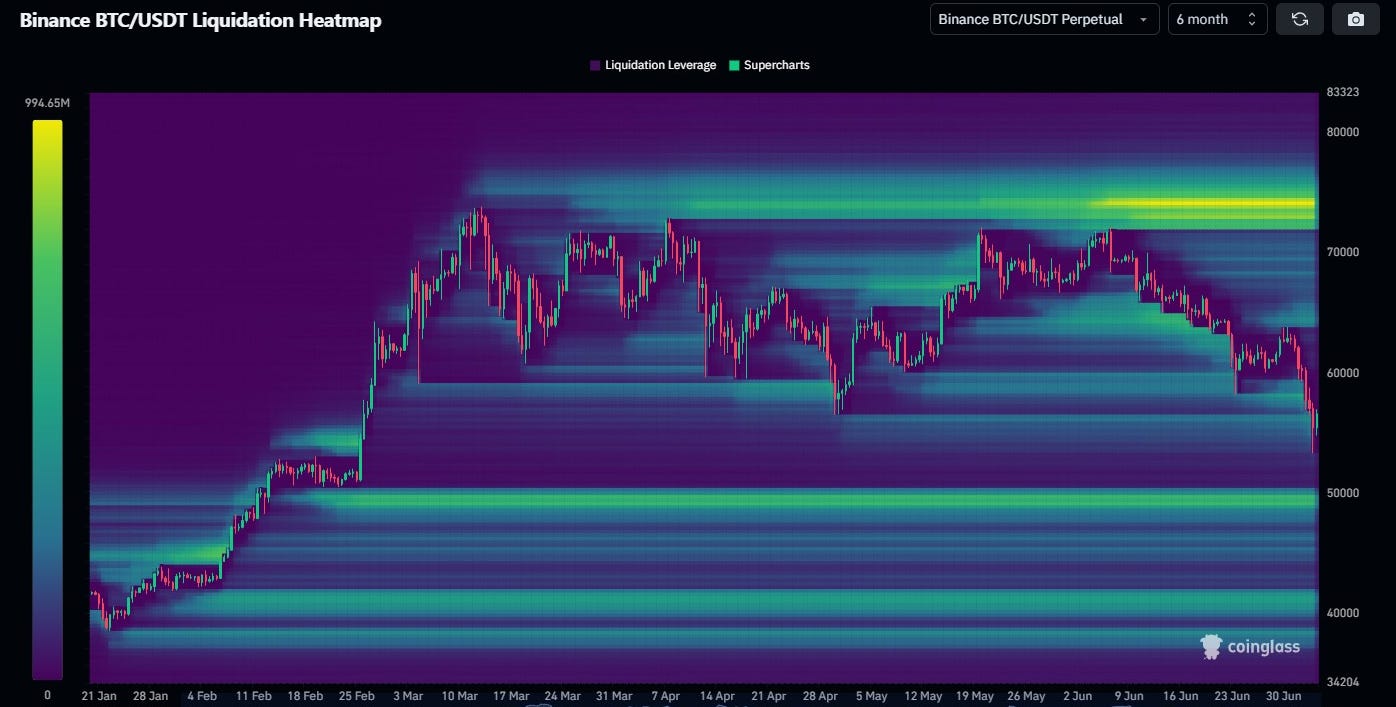

The Bitcoin 6-month heat map from Coinglass is showing more liquidity down at $50,000, but not a lot between the current price at $56,000 downward.

Source: Coinglass

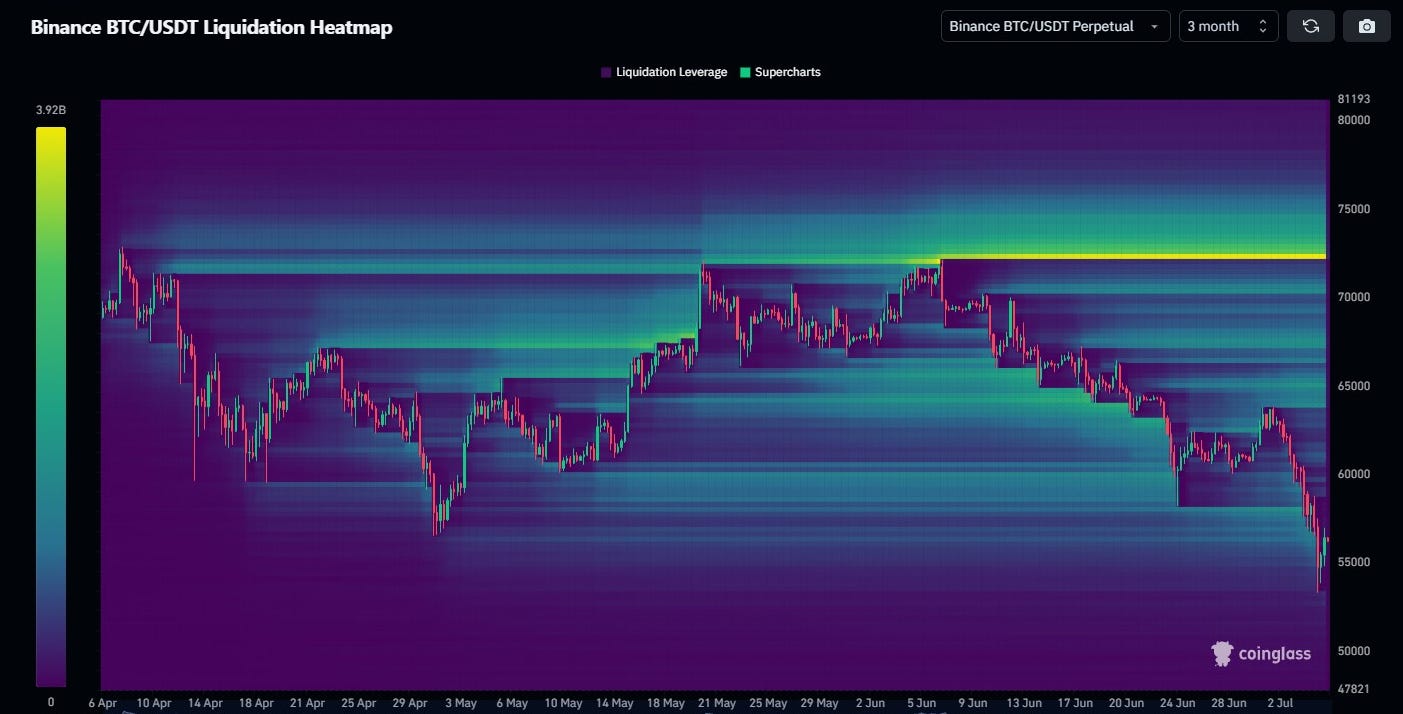

Zooming into the 3-month heat map, things start to come into perspective. There is not much below the price to push it more in that direction. There is, however, a very juicy level up at $72,000 that should attract attention from traders and become the Schelling point.

Source: Coinglass

Zooming in yet further to the 1-month heat map, we can see all the liquidity above the price.

Source: Coinglass

Lastly, for our medium-term forecast, let’s look at the Fibonacci retracement and extension. As you can see the golden pocket between 61.8% and 66% retracement aligns well with the top of our resistance zone discussed above. The 161.8% extension is up at $86,000. Therefore, the medium-term forecast for the EOY is at least $86,000. My previous forecasts honed in on $98-102,000 due to cycle patterns, post halving rallies, and projected returns. The $100k level is clear psychological resistance, so will be very hard to break this year.

Cycle Forecast for Bitcoin

My cycle target for most of the last two years has been for an ultimate top in the $200k-$400k range. I have narrowed my time frame to roughly in the middle of next year due to halving timing. Bitcoin has very clear 4-year cycles that tend to top in November or December, followed by a cycle bottom 1 year later in the same months. This pattern slightly changed in 2021, with a double top. The first top may have been driven by the halving cycle, and the second by seasonal factors. If that is the case, we can expect another double top cycle this time due to the halving continuously moving earlier.

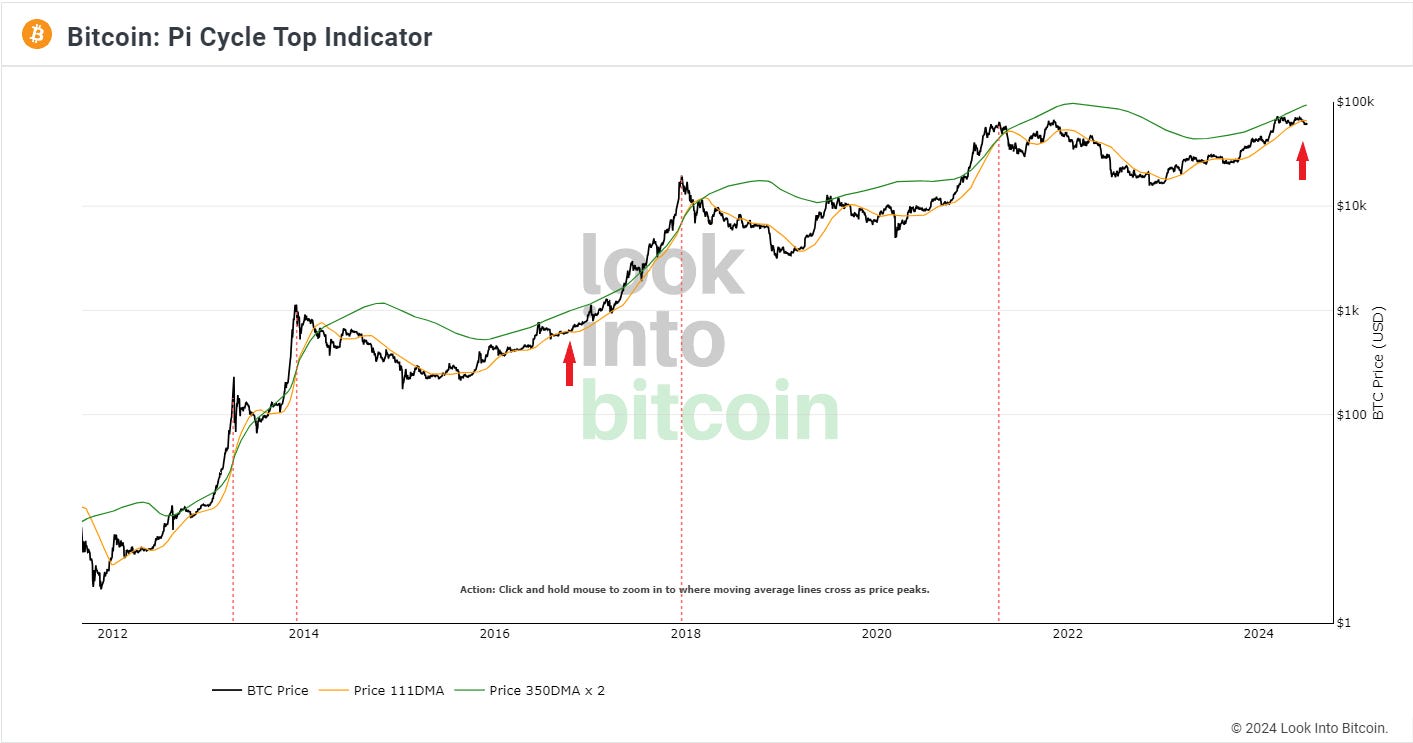

I will be watching and updating highly accurate cycle timing metrics like the Pi-cycle top in future posts. Below, I highlighted the period that most closely represents where we are today with red arrows. We are obviously far from a cycle top.

Source: LookIntoBitcoin

Conclusion

Bitcoin is oversold on most time frames and is behind on the halving cycle timeline. Near-term I expect price to challenge resistance levels above price, getting as high as $66,000 in the next two weeks. By the EOY the bull market should be obviously in high gear with levels of interest at $86,000 up to $100,000. Cycle timing has two driving forces, the 4-year cycle from the halving which is getting earlier in the year each cycle and the seasonal Nov-Dec peak and bottom timing. Therefore, there is a possibility that we will have another double top this cycle in mid- and late-2025 between $200-400k.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!