Altcoins Falter Compared to Bitcoins; BitVM Opens New Possibilities

Bitcoin stays strong in 3-month period of altcoin destabilization. Launch of BitVM protocol allows new functionalities of Bitcoin blockchain to further encroach on altcoin selling points.

With Bitcoin holding steady as Ethereum and other altcoins have dropped, the newly-unveiled BitVM protocol may allow the Bitcoin blockchain to execute completely new functions and out-compete Ethereum’s smart contracts.

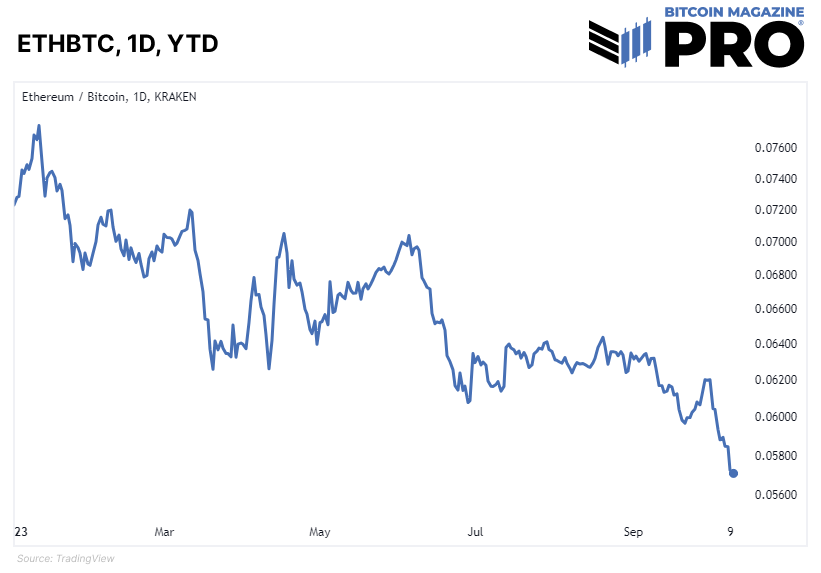

The third quarter of 2023 has seen some difficulties in the world of cryptocurrency. Although Bitcoin hit a high of nearly $30k in July, rumors around the upcoming spot ETF and major developments in world conflict have caused Bitcoin’s price to fluctuate slightly. Nevertheless, losses have been temporary, and overall the trend over three months has been quite stable. However, this ability to bounce back has not been shared with the vast world of altcoins. Data from October 9 showed that the entire world of cryptocurrencies had been shaken in the last three months, however Bitcoin managed to outperform all of these, and while Ethereum made some significant gains over other altcoins, it still underperformed bitcoin.

This period of success for Bitcoin can be measured in other metrics besides its valuation, however. Downward trends across the world of altcoins has led to Bitcoin steadily gaining in terms of market cap since mid-August. Bitcoin started in July with more than 50% of the market cap in all traded cryptocurrencies, and despite losing a small amount of ground, by October it definitively returned to its position at the head of the pack.

Although Ethereum’s supporters could take some solace in knowing that their coin maintained its traditional status as second-fiddle to Bitcoin, worrying signs have been showing in its performance. On October 10, for example, new data collected over 2023 shows that whales have offloaded more than $8 billion worth of the altcoin in the past few months. And they show no signs of buying it back. Whale accounts, also quite common to Bitcoin, are single wallets or owners that own gargantuan quantities of a specific asset, and their purchasing habits have had a great degree of influence over the market. Now that a dramatic dump like this is quantifiable and well-known, it could spark greater panic.

Fears of a general run on a cryptocurrency are reasonably common, and all of the leading assets have experienced them. Even bitcoin has seen its fair share of massive price fluctuations over the years. Something far less survivable, however, is a scenario where a project’s entire raison d’etre is thrown into question. Although Ethereum founder Vitalik Buterin initially was a supporter of Bitcoin, he described Bitcoin’s ability to execute smart contracts as “weak” and developed its number one competitor: a cryptoasset designed at the foundation to automatically process a wide range of agreements between users. Ethereum’s emphasis on the smart contract system sacrificed much of the trustless and decentralized nature of the Bitcoin blockchain, but still served as a selling point for its position as second-best.

This whole state of affairs may have already been overturned, however. On October 9, developer Robin Linus of ZeroSync proposed a new protocol for the Bitcoin blockchain: BitVM. Essentially, he has devised a way to construct Turing complete computations off-chain, and enforceable on-chain, all without using a soft fork. Linus has devised a method to create logic gates directly on the blockchain using existing Bitcoin script.

There is a catch to this protocol, however. Essentially, the blockchain was never built to accommodate these logic gates, and actually processing every contract like this would be extremely inefficient. Instead, the currently-proposed version of BitVM involves the parties in a smart contract performing their own calculations off-chain, and cooperating to put in the correct values and resolve the contract. Therefore, these smart contracts are not enforced step-by-step on-chain in a trustless manner, but anyone who violates the terms of a contract can be punished directly by the Bitcoin blockchain itself by showing a few steps of the incorrectly executed parts of the contract. It will just take time to dole out the punishment.

Linus in the whitepaper described a wide variety of new functionalities that can be carried out through these logic gates, claiming that “Potential applications include games like Chess, Go, or Poker, and particularly, verification of validity proofs in Bitcoin contracts. Additionally, it might be possible to bridge BTC to foreign chains, build a prediction market, or emulate novel opcodes.” It will likely be some time before smart contracts on this protocol are able to be properly designed and implemented for use in the real world, but it is nevertheless groundbreaking that such a protocol exists.

With the possibility of Turing-complete smart contracts directly on Bitcoin’s blockchain, it seems clearer than ever that the diverse and ever-changing nature of Bitcoin has completely earned its position as the world’s dominant cryptoasset. It is not as if Ethereum and every other altcoin will collapse overnight while a project like BitVM is still in its infancy, but Bitcoin is steadily chipping away at any possible reason to choose any of its competitors. And, as we can see from the state of the markets, these competitors are already on shaky ground. Betting on Bitcoin, on the other hand, seems safer than ever.